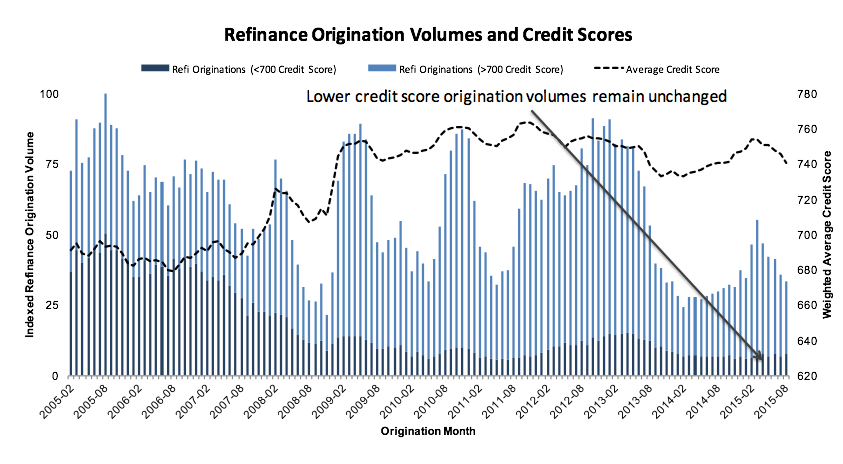

At first glance, a new industry report from Black Knight Financial Services (BKFS) appears to show that the average credit score for refinance applications is loosening.

However, with further investigation, the truth is that there is only a decrease in the number of high credit score borrowers since most of them likely already refinanced and taken advantage of the low interest rates.

The chart shows that lower credit score origination volumes remain unchanged, while the number of high credit score borrowers is declining.

Click to enlarge

(Source: Black Knight)

On top of all this, refinance originations as a whole have steadily declined since March, showing a 'refi burnout,' as most borrowers who were both interested in and could qualify for refinancing have already done so (and in many cases, numerous times).

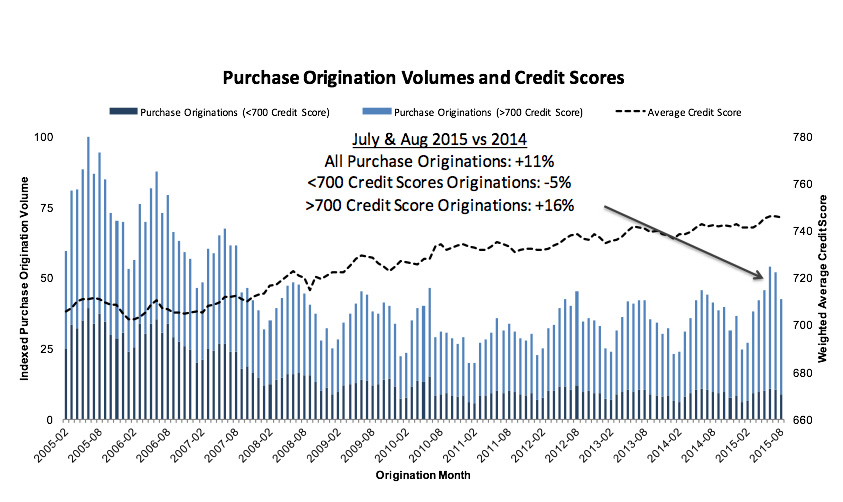

On the other side of the lending table, purchase mortgage originations surged in 2015, with Q2 up 15% over 2014 and Q3-to-date up 11% so far.

And unlike the refi market, high-credit borrowers are driving the surge.

Purchase loan activity among borrowers with less than a 700 score is flat to slightly down on a year-over-year basis.

Only 20% of purchase originations over the last 3 months have come from borrowers with credit scores below 700, the lowest level in over 10 years.

Additionally, weighted average credit score for purchase mortgages has hit a record high of 755.

The chart below shows the surge this year, compared to prior years.

Click to enlarge

(Source: Black Knight)