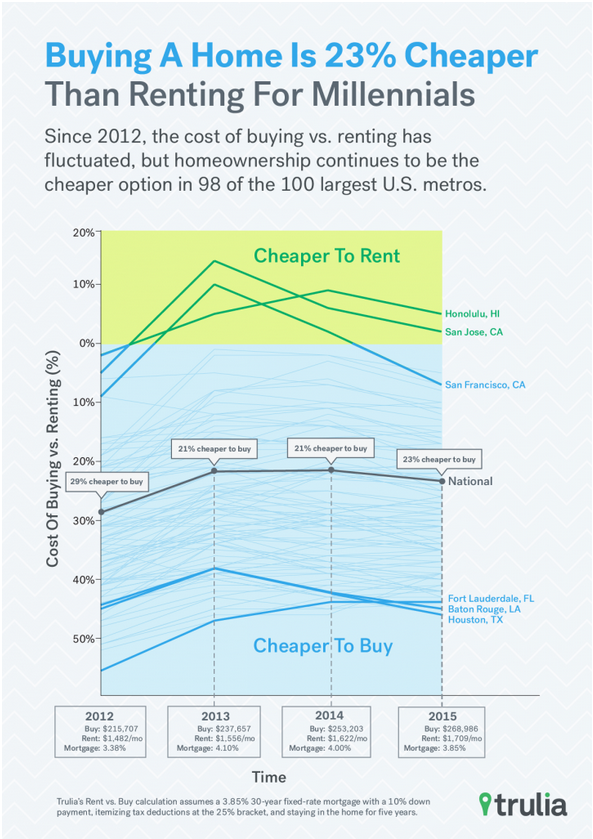

Even with their unique financial and living situations, it is still better for Millennials to buy a home rather than rent in most cities.

Usually, when Trulia crunches its home-buying numbers, it assumes a 30-year, fixed-rate mortgage with a 20% down payment for households moving every seven years.

Following these guidelines, buying is 36% cheaper than renting on a national basis, based on September home prices. Buying is also cheaper than renting in each of the nation’s 100 largest metros.

But the problem with this model is that it doesn't fit the situations that average Millennials face. Instead, Trulia said that it is typical for young households (ages 25-34) to move every five years and only be able afford up to a 10% down payment.

This latest edition of Rent vs. Buy considers these Millennial factors. Trulia also assumed a 3.85% mortgage rate on a 30-year fixed-rate loan, itemized federal tax deductions and a 25% tax bracket

Click to enlarge

(Source: Trulia)

According to the results, “Buying is not only 23% cheaper than renting nationally, it is also cheaper than renting in 98 of the nation’s top 100 markets,” Trulia said.

While this calculation shows that buying is still cheaper than renting, the difference is pretty close in some places, especially in California.

The report noted that there are additional economic conditions that influence today’s market.

For example, home-price growth has outpaced rent growth since 2012, which favors the rent side of the buy vs. rent equation. But low interest rates help offset this issue.

This chart shows the markets where renting beats homebuying for Millennials.

Click to enlarge

(Source: Trulia)