Millennials are slow to enter homeownership, opting lately to go with cheaper options, like living with their parents. A study by Liberty Street Economics attempts to answer what forces might be driving millennials home.

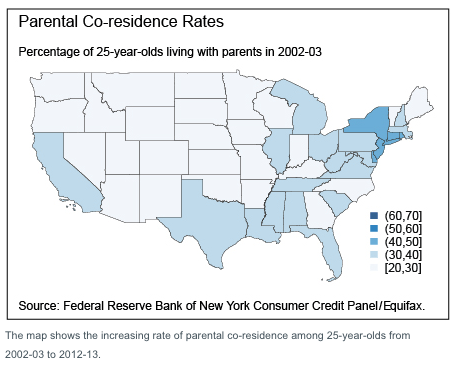

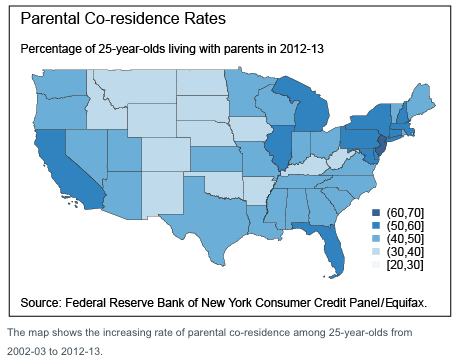

For starters, the percentage of 25-year-olds living with their parents in 2002-3 is drastically higher compared to 2012-13.

The study defined an individual to be “living with his or his parents” if they are living with any individual who is at least fifteen years older, which could include parents as well as aunts or uncles, grandparents, or (rarely) other considerably older household members.

In 2003, between 20% and 30% of twenty-five-year-olds lived with their parents in 25 of the 48 states. By 2013, all 48 states had parental co-residence rates of more than 30%.

Click to enlarge

Source: Federal Reserve Bank of New York Consumer Credit Panel/Equifax

Click to enlarge

Source: Federal Reserve Bank of New York Consumer Credit Panel/Equifax

So what forces are driving Millennials home?

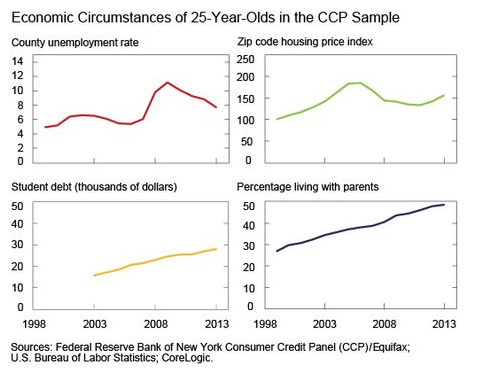

The chart raises two key questions:

1. If staying longer with parents is a symptom of economic difficulty, and economic growth is its cure, then why do we see a persistent, almost linear climb in the rate of co-residence with parents, rather than, for example, peaks and troughs that track unemployment over the business cycle?

2. Does the similarity in the aggregate trends in student debt and parental co-residence truly mean that graduates (and dropouts) are staying or returning home in order to tackle growing debt burdens?

Click to enlarge

Source: Federal Reserve Bank of New York Consumer Credit Panel/Equifax

Answers:

1. While improvement in youth employment conditions enables young people to move away from their parents, rising local house prices are estimated to have forced many young people to move back home.

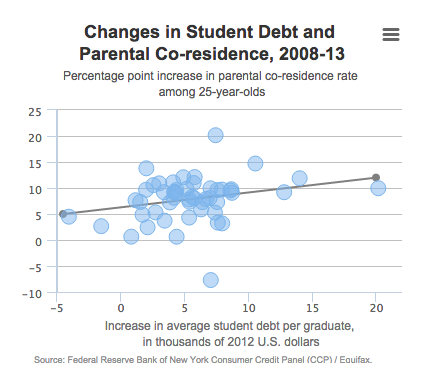

2. There is a positive correlation between a state’s student debt growth and the rate at which its twenty-five-year-olds live with their parents. (See chart below)

Click to enlarge

Source: Federal Reserve Bank of New York Consumer Credit Panel/Equifax