Investors tend to gravitate toward renting properties rather than flipping them, according to a new November industry report from Auction.com.

The Real Estate Investor Activity Report is a nationwide survey of real estate investors bidding on properties offered for auction during the month.

“Real estate investors appear more likely to flip a property in those regions where home values are higher,” said Auction.com Executive Vice President Rick Sharga.

“Higher prices can translate to a faster and potentially more significant short-term return on investment. The hold and rent strategy seems most popular in markets where home prices are lower, allowing investors to charge a more competitive monthly rental rate and still produce reasonable returns over an extended period of time,” he added.

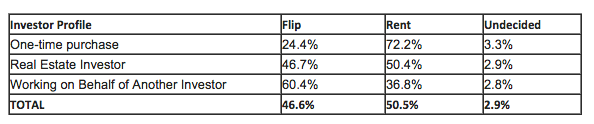

Investor intent:

Click picture to enlarge

Source Auction.com

Respondents who indicated that they were making a one-time purchase continued to prefer a hold-to-rent strategy, along with respondents who identified themselves as full-time “real estate investors.”

However, the majority of respondents that indicated they were working on behalf of another investor overwhelmingly preferred to flip.

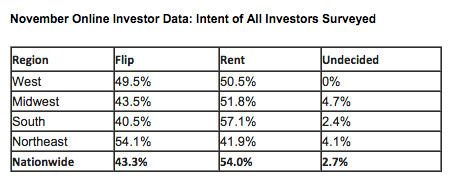

Across the nation:

Click picture to enlarge

Source Auction.com

Purchasing property to rent is more prevalent in the Midwest and South, while there is a higher tendency to flip among real estate investors in the Northeast.

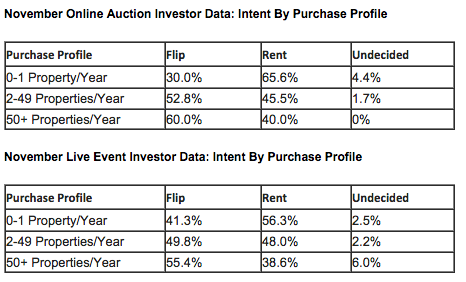

Regional events:

Click picture to enlarge

Source Auction.com

Meanwhile, investors bidding at live events appear to be more likely to flip the properties they purchase, but there were very strong regional variances.

Investor size:

Click picture to enlarge

Source Auction.com

Additionally, investors purchasing multiple properties per year – particularly institutional investors — preferred to flip.