While the past year failed to meet housing expectations due to a torrential winter, despite surprisingly low mortgage rates, not all predictions were off, with one of the most accurate predictions noting housing shifted to a purchase-money dominated market.

Freddie Mac’s December Economic and Housing Market Outlook report takes a look back at five predictions for 2014 and whether they did or did not meet expectations.

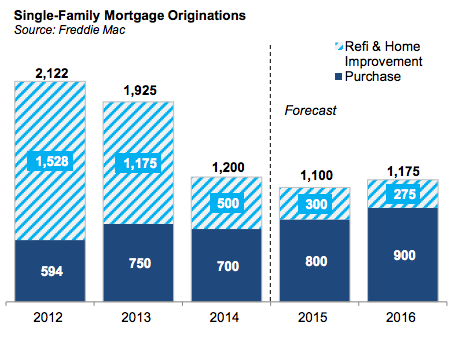

1. Mortgage Originations

2014 Prediction: Refinance activity would finally take a backseat to purchase activity, marking the first majority purchase-money origination market in 14 years. Also, the gains in purchase lending would be insufficient to offset the quickly shrinking refinance market.

Reality and future: While the shift in origination activity did materialize in 2014, Freddie expects it to continue in 2015, with purchase-volume gains unlikely to make up for further declines in refinance activity. We project an 8% further decay in single-family originations in 2015, even though purchase-money volume will rise.

Click to enlarge

Source Freddie Mac

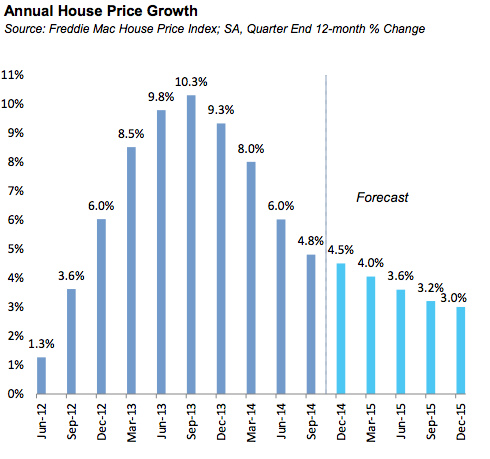

2. Home values

2014 Prediction: In 2013 a number of hard-hit depressed housing markets reported annual appreciation in excess of 20%, reflecting strong investor demand for undervalued homes. But these strong gains were unlikely to continue. While low mortgage rates and limited home sale inventories were expected to support further appreciation, most expected a significant slowdown in value gains for 2014.

Reality and future: Home values followed predictions and increased but at a more moderate clip in national metrics for 2014. For 2015, Freddie expects further moderation in the national Freddie Mac House Price Index growth, to about 3%.

Click to enlarge

Sourse Freddie Mac

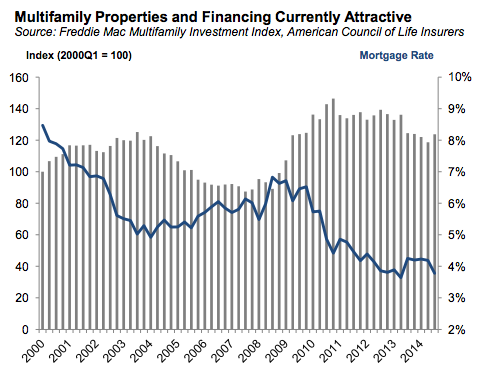

3. Rental markets

2014 Prediction: The market forecasted the apartment rental market to continue to gain steam in 2014 and further lead the recovery in the housing market with an increase in apartment completions and starts.

Reality and future: It was a strong year for the rental market, with vacancy rates falling to the lowest level since 2000, absorption rates on newly built apartment rentals rising and developers starting the largest number of rental apartments in 25 years. These same conditions point to further origination gains in the multifamily market over the next two years.

Click to enlarge

Source Freddie Mac

4. Home sales

2014 Prediction: The consensus view was a gain in home sales, with some expecting sales to rise from 5.5 million in 2013 to over 6 million in 2014. (We forecasted an increase to 5.9 million in 2014). The consistent theme was faster economic growth in 2014 – with most forecast professionals generally predicting from 0.5 to 1.0 percent faster growth than during 2013.

Reality and future: Unlike predictions, the economy contracted at a 2.1% annualized rate during the first quarter of 2014, raised fears of another lackluster macroeconomic environment, and calendar-year growth will likely end up 0.5 to 1.0 percent slower than in 2013. Over the second and third quarter of 2014 the economy grew at better than a 4% annualized pace and is well poised to expand close to a 3% pace in 2015.

5. Mortgage rates

2014 Prediction: Mortgage rates were on the rise heading into 2014 and were expected to continue to gradually rise throughout 2014.

Reality and future: Opposite of forecasts, mortgage rates generally moved lower during the course of 2014. But an extended period of extraordinarily low mortgage rates remains a temporary, with rates expected rates to increase gradually in the coming year.