The slides from Stonegate Mortgage’s (SGM) CEO Jim Cutillo's presentation at the 2014 FBR Fall Investor Conference in New York on Tuesday reveals an update on how the lender plans to continue to grow and thrive in a flat market.

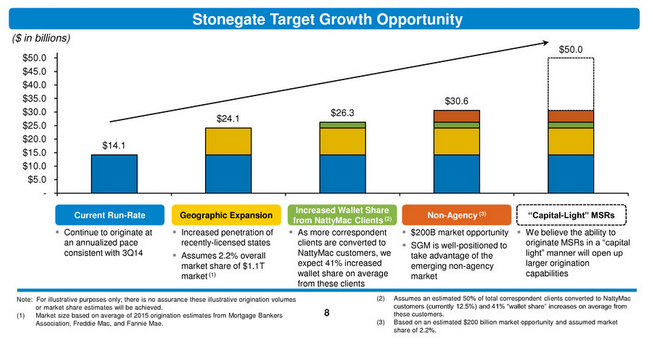

A previous presentation from Cutillo in September included a chart on Stonegate’s target growth opportunities. This latest presentation gives an updated version, showing that the company expects more growth than originally estimated.

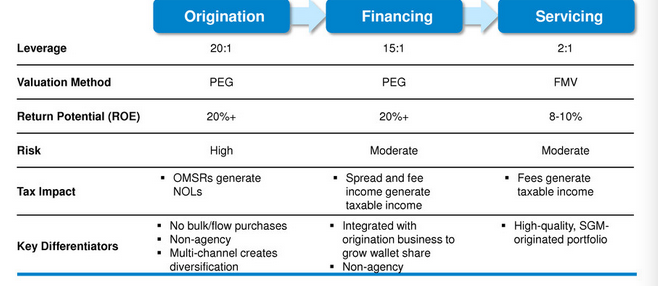

First, of the lender’s three areas of focus — origination, financing and servicing — it noted that origination offers the most attractive risk and return characteristics of the three.

Click to enlarge

(Source: Stonegate)

“Geographic expansion, increased wallet share and the emerging non-agency market will drive origination, financing and servicing growth,” the presentation slides said.

Its newest chart shows greater growth than what was previously estimated.

Click to enlarge

(Source: Stonegate)

In its latest third-quarter earnings report, Stonegate’s mortgage loan origination volume increased, growing 7% to $3.5 billion, compared to $3.3 billion in originations in the second quarter of 2014.

This is a 51% rise from origination volume of $2.3 billion in the third quarter of 2013.