Want to know why mortgage applications continue at historic lows? Well, as it turns out, there are many reasons why homeownership continues to drop.

Even while there is still a widespread preference for homeownership in America, 35% of households still rent, and of them, 20% report no intentions to buy, according to a report from Rachel Bogardus Drew, a post-doctoral fellow with the Harvard Joint Center for Housing Studies.

And when looking at the latest numbers, the U.S. Census Bureau’s third-quarter homeownership report found that the national vacancy rate hovered around 7.4% for rental housing and 1.8% for homeowner housing, barely moving from the second quarter’s results.

So why aren’t people wanting to own a home?

“We know from my prior research that some demographic groups are less likely to expect to own in the future, including whites, older renters, those with lower incomes, and those without families,” Drew said.

“Yet regression analyses based on demographic variables alone can account for only about 10% of the variation in renters’ future tenure plans. Thus we must consider some attitudinal factors when seeking to understand what drives intentions to rent for the long term,” she added.

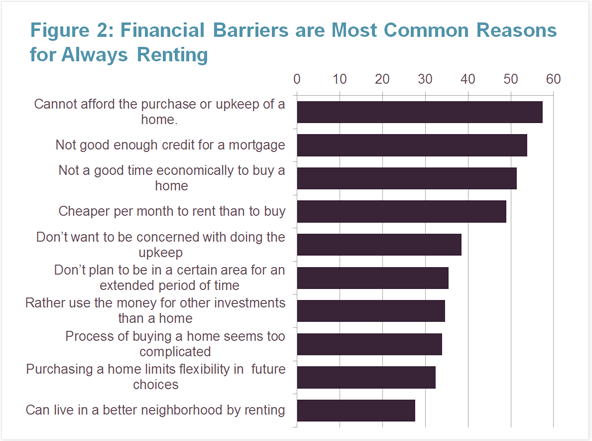

The chart below lists the 10 main reasons people either don't want or can't get a mortgage.

(Source HJCHS; click to enlarge)

Drew explained that the results show a third of renters, or 10% of all households, rent because of lifestyle and personal preferences. However, more than half of lifetime renters see their tenure as constrained, either by their own financial circumstances or by macroeconomic conditions.

And looking toward future trends, renters and unlikely to change their plans anytime soon due to tight mortgage lending, home prices rising and sluggish income growth.