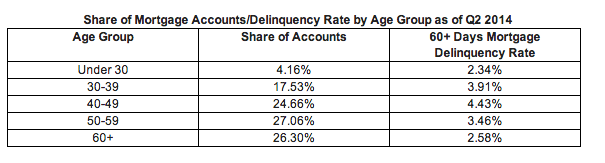

The youngest group of mortgage borrowers posted the lowest mortgage delinquency rate, falling to 2.34% at the end of the second quarter, according to a new report from TransUnion.

“Mortgage delinquency rates continue to drop and we are seeing this decline across all age groups,” said Steve Chaouki, head of financial services for TransUnion.

However, it is important to note that this age group also makes up the smallest portion of mortgage accounts, only representing 4.16%.

(source TransUnion: click for larger image)

Overall, the mortgage delinquency rate declined for the 10th consecutive quarter, decreasing to 3.46% at the end of Q2 2014. This is down nearly 20% in the last year.

“Overall, the improvements in the mortgage delinquency rate can be attributed to a number of factors. These include the clearing of severely delinquent accounts through foreclosure as well as a lower rate of new delinquencies from post-recession vintages, which generally are of significantly higher credit quality and have experienced much better performance than mortgages originated before the recession,” Chaouki said.

“This dynamic is likely driving the low delinquencies among younger borrowers. It is encouraging to see younger borrowers perform well, since their generation was significantly impacted by the recession and their loans are among the newest,” he added.

Meanwhile, Monday morning the S&P/Experian Consumer Credit Default Indices reported that household debt continued to fall in July as the first mortgage default rate dropped to .88% from .89% last month.