Americans are becoming more optimistic about buying a home, with 67% of people saying they plan on purchasing a home, and of that amount, 32% are looking to buy within the next two years.

The PulteGroup (PHM) Home Index surveyed 1,004 adults on their sentiment about the U.S. economy and how current housing conditions are impacting future homebuyers.

According to the survey results, 74% of adults feel the economy has remained steady or improved in the last year.

As a result, 57% of adults think now is a good or excellent time to purchase items they want or need, especially when it comes to entering the housing market.

Millennials and move-up buyers are the most engaged consumer segments, with 85% and 71%, respectively, intending to purchase a home in the future.

“For the first time in years, Americans have a growing sense of optimism that the housing market is improving, and that these positive changes may be sustainable,” said Margaret Gramann, senior vice president of sales for PulteGroup.

“This favorable outlook is giving them the confidence to pursue more meaningful, big-picture life opportunities they may have otherwise put on hold,” Gramann added.

There are two main drivers to purchasing a home: the need for more space and the view that owning a home is a smart financial investment.

Currently 70% of home shoppers plan to spend as much or more money on their next home, along with 64% of people saying they prefer to spend on a home that’s move-in ready rather than spend less and renovate.

“Whether it’s a first-time or move-up buyer, or an active adult, purchasing a home is a major life decision and Americans are recognizing the importance of maximizing what they view as a long-term investment,” said Gramann. “They’re aiming to create value in a home that meets their specific wants and needs from day one, and if that means spending more money, they’re willing to do so because of confidence in the market.”

And as consumer demand for housing increases, so does the demand for more credit.

For borrowers who already have a home, the demand for home equity lines of credit is increasing.

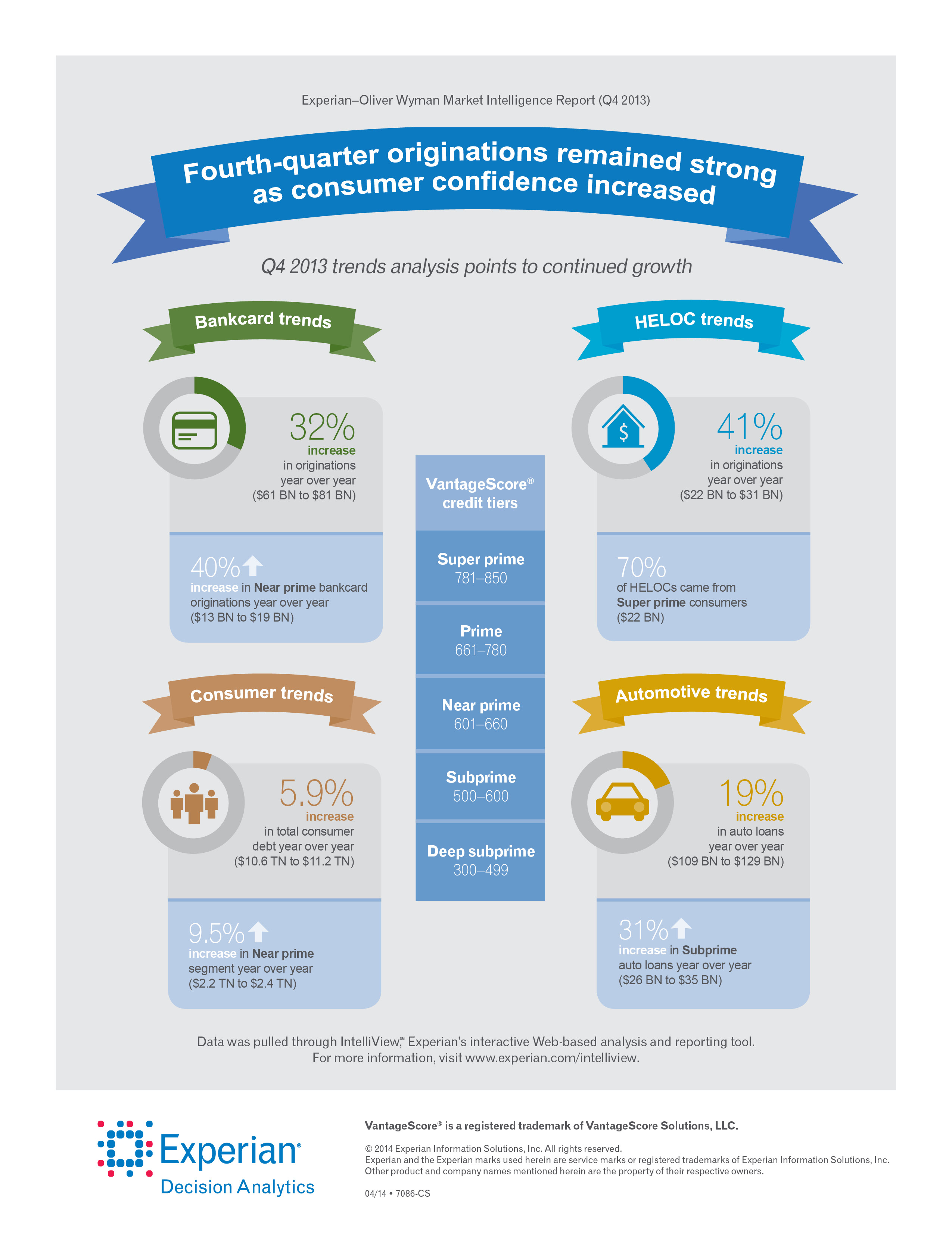

Experian found a 41% increase in originations year over year, with 70% of HELOCs coming from super prime consumers. See the inforgraphic for more detail (click image for bigger picture).