Despite anecdotal reports of lenders lightening up requirements, mortgage credit has not really loosened at all.

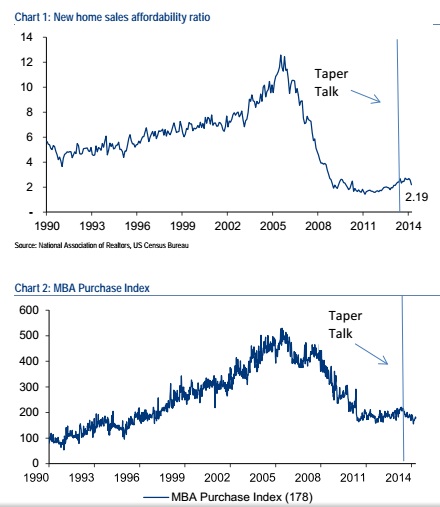

In their Securitization Weekly Overview, Bank of America Merrill Lynch bond strategists Justin Borst and Chris Flanagan, mention Federal stimulus as trying to get lending going. Their two charts of what's happened since the Fed began its withdrawal from the mortgage bond and Treasurys markets show that mortgage credit is still way tight. And the charts extend back years, for historical reference.

"Obviously, the Fed has done enormous work to lower interest rates and help interest rate sensitive sectors such as housing. This metric gauges how much bang for the buck the Fed is getting," they write.

"As can be seen, the ratio had been rising prior to last year’s taper talk but has since stalled at what are still extremely low levels."

Even in the warmer weather Borst and Flanagan don't predict a big boost this Spring.

A big part of the lessening in mortgage credit is not just explained by the Fed withdrawal. The FHA market share is also collapsing.

"We see that FHA has lost significant share of the purchase market over the past two years, dropping from almost 40% share in 2012 to the most recent value of 22%," they add. "The introduction of 80 basis points of additional mortgage insurance premiums on FHA mortgages between November 2010 and April 2013 likely contributed to this decline in share."

This leads to the conclusion that once abundant pipeline for first time homebuyers is now drying up.

"We view this as a particularly important part of the story, as it suggests that the ability to pass the torch on housing to borrowers at the low end of the credit spectrum, including first time home buyers, may be more constrained than aggregate affordability measures would indicate," the strategists conclude.