The reverse mortgage portion of the Federal Housing Administration’s Mutual Mortgage Insurance Fund (MMIF) has reached a positive capital ratio on the overall government-backed portfolio, according to an annual actuarial review of the fund’s finances and FHA’s Annual Report to Congress, both released Monday morning. Its economic net worth value sits at approximately $3.8 billion compared with the -$492 million figure recorded in 2020.

This represents a major positive shift in the health of the Home Equity Conversion Mortgage (HECM) book of business, marking a third consecutive annual improvement over the issues that have been present in it over the last few years. The positive performance of the HECM book of business is largely attributed to the levels of house price appreciation that the U.S. housing market has seen recently.

“The financial performance of the HECM portfolio has improved in each of the last three years and is now positive for the first time since FY 2015,” FHA’s Annual Report to Congress reads. “The projections of the HECM portfolio’s financial performance are more sensitive to changes in Home Price Appreciation (HPA), and as a result, the strong HPA experienced in recent years explains the increase in the ratio in FY 2021.”

The standalone MMI Fund Capital Ratio for HECMs grew by 6.86 percentage points, from negative 0.78% in FY 2020 to 6.08% in FY 2021.

“MMI Fund Capital for the HECM portfolio increased by $4.3 billion over the last year,” the report reads. “The improved projection for HECM is largely based on a decrease in the [net present value] (NPV) of Projected Losses that generated $3.2 billion of new MMI Fund Capital[.]”

At the end of fiscal 2021, the Home Equity Conversion Mortgage (HECM) cash flow net present value, a measure reported to Congress by the Department of Housing and Urban Development (HUD) and endorsed by actuarial firm Pinnacle Actuarial Resources, was estimated to be $390 million. That’s an increase from the -$2.09 billion estimated in fiscal year 2020.

In contrast, the fiscal condition of FHA’s forward portfolio is marked by an economic net worth of $16.48 billion and a capital ratio of 7.99%, an improvement over the 6.31% recorded in fiscal year 2020.

“The strength of the fund is a promising sign and solidifies the important role FHA fulfills in making homeownership a reality for first-time homebuyers and those with lower incomes.” said HUD Secretary Marcia Fudge in an announcement of the report’s release. “This year, our Administration took unprecedented steps to deliver relief to those devastated by the pandemic. Managing the strong fiscal health and performance of the FHA program is a top priority, and I am encouraged to see the MMI Fund remain resilient through the events of the past year.”

No key HECM policy recommendations, focus remains on pandemic assistance

The priorities of HUD and FHA in terms of policy priorities aimed at the HECM program remain focused on providing assistance to borrowers impacted by the COVID-19 coronavirus pandemic, according to HUD senior officials.

“As far as the policy perspective of HECM, we are very aware that there are some seniors that are in need, and we are trying to tailor our policy response in order to address those needs,” a senior official said. “[This year], we’ve issued a few waivers in order to assist HECM borrowers who are in arrears due to taxes and insurance by waiving the $5,000 cap for arrearages for repayment plans. Also, we waived the requirement for borrowers to maintain their own taxes and insurance for three years before services can step in to cure. So there are things that we’re looking at in order to make this easier for them in order to handle the hardships of the pandemic.”

FHA also continues to look at assistance options for HECM borrowers made possible earlier this year with the passage of the sweeping American Rescue Plan Act, which contains $10 billion to create a Homeowners Assistance Fund (HAF) to be distributed directly to states, tribal lands and other territories to provide assistance to people struggling with housing costs. This Fund can be applied to some of the primary fees that HECM borrowers are required to keep up with.

“We’re continuing to work with State Housing Finance Agencies (HFAs) as we look at the incorporation of HAF funds to see what we can do in order to help facilitate that conversation and the implementation of those funds,” a HUD senior official said. “[We’re doing this] in order to help borrowers who are struggling, [including those] who are in the HECM portfolio as well.”

Refinance activity, demographic data

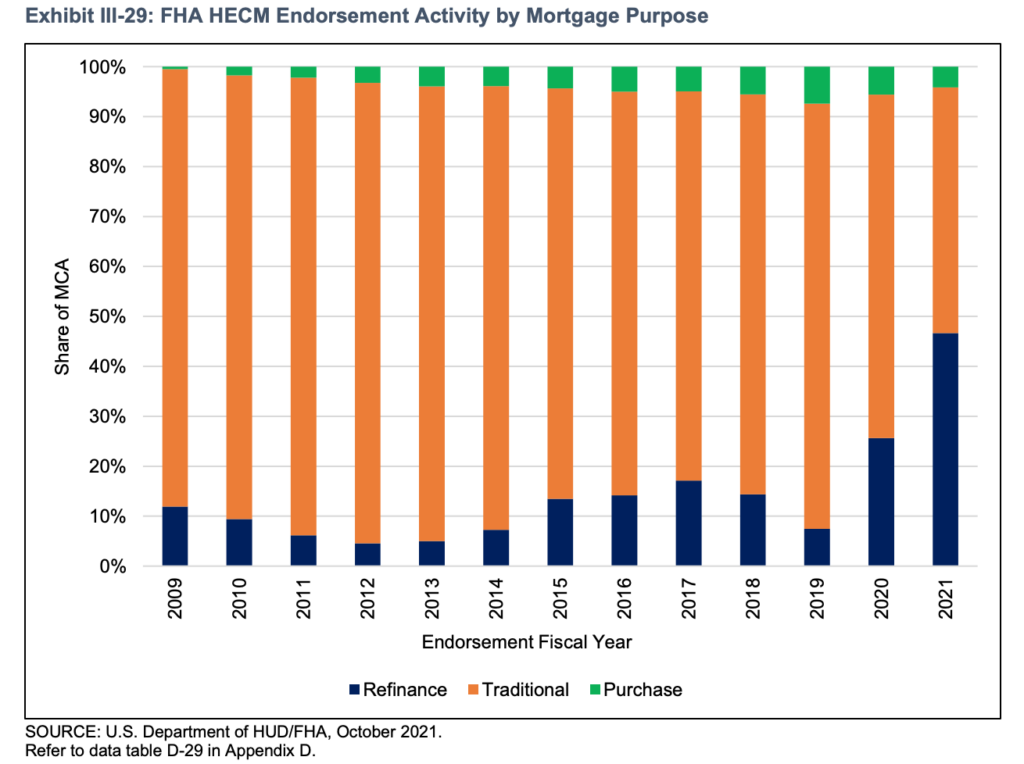

The report contained information regarding HECM-to-HECM refinances as a share of total FY 2021 endorsements, with FHA data indicating what has been observed by industry analysts: refis count for nearly half of all HECM endorsement activity in FY 2021.

“[…] The share of HECM MCA for refinance transactions nearly doubled from FY 2020, rising from 25.66% to 46.68% in FY 2021, as homeowners took advantage of favorable house prices and low interest rates to extract more equity,” the report details.

Based on the data present in the report, refinances in FY 2021 make up the largest share of total HECM endorsements going back to at least 2009. Industry analysts and other participants have been vocal recently about the trend of refinance activity bolstering industry volume to an unsustainable degree, considering that the amount of loans able to be refinanced is a finite resource especially when considering the product’s penetration rate into its target market.

The Annual Report contained updated data about the demographic composition of HECM borrowers in FY 2021. As in years past, multiple borrowers are typically served across the entirety of the HECM endorsements in the fiscal year. This is closely followed by single female borrowers, who outnumber their single male counterparts according to the data.

“In FY 2021, 35.72% of HECM endorsements served singular female borrowers, 20.52 percent served singular male borrowers, and 40.75 percent served multiple borrowers,” the report reads. “The composition of HECM borrowers has remained relatively consistent since FY 2009.”

The report also includes details of borrowers by ethnicity, and the overwhelming majority of HECM borrowers remain White, with a much lower share of endorsements being made up by Black and Hispanic borrowers, respectively. However, the share of borrowers choosing not to identify their ethnicity has increased in recent years.

“In FY 2021, 71.79% of HECM endorsements served White borrowers, 6.37% served Black borrowers, and 5.41% served Hispanic borrowers,” the data says. “Documentation of race/ethnicity is voluntary. The share of non-respondents for HECMs has climbed in recent years, reaching 14.63% in 2021.”

The average age of a HECM borrower has largely remained consistent with prior years, though ticked up very slightly in FY 2021 to 73.95 years from 73.51 years in 2020.

Industry response, comparison to 2020

The National Reverse Mortgage Lenders Association (NRMLA) sees the improvement in the HECM book of business as indicative of program changes having the desired impact after their implementation. This is according to Steve Irwin, president of NRMLA.

“Today’s report shows continued improvement in the performance of the HECM program within the MMI Fund,” Irwin told RMD. “The recent programmatic changes, coupled with the current macro-economic trends, continue to have their intended effect.”

Other reverse mortgage companies deferred to the statement provided by NRMLA for comment related to the report.

The FHA Annual Report this year marks a notable departure from the 2020 report, which itself described that the HECM portfolio remained a “drag” on the MMI Fund overall. One major difference between the 2021 Annual Report and the report from one year ago is that FHA is not making any programmatic or policy recommendations regarding adjustments that should be made to the HECM program.

Last year, FHA described the volatility of the HECM program in far more critical terms, describing the forward book as “subsidizing” the HECM book and calling out the HECM loan limit structure as in need of review. Last year’s report also recommended that Congress establish a separate capital reserve for the HECM program in an effort to minimize losses to the forward book of business.

Read FHA’s Annual Report to Congress for fiscal year 2021 at HUD. Find perspective on the forward mortgage side of the MMI Fund at HousingWire.