Senior housing wealth has reached yet another high.

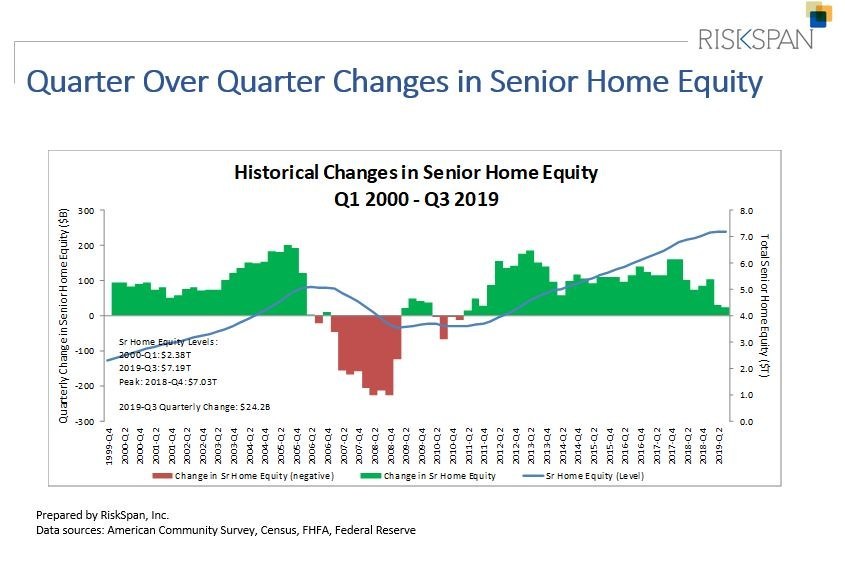

Homeowners ages 62 and older saw their housing wealth grow 0.3%, or $24 billion, in the third quarter this year.

That puts overall senior wealth at a record $7.19 trillion in Q3, according to the National Reverse Mortgage Lenders Association.

Overall senior housing wealth originally hit an all-time record in Q2 of $7.17 trillion.

Homeowners 62 and older also saw their housing wealth increase by 0.5% percent or $32 billion in Q2.

The RiskSpan Reverse Mortgage Market Index rose to 259.19 in Q3, another all-time high since the index was first published in 2000. This index is released quarterly and is based on quarter over quarter change in senior home equity.

The report says that this is most likely due to an estimated 0.5%, or $40.7 billion increase in senior home values. This is offset by 1%, or a $16.5 billion increase of debt held by seniors.

“Research suggests that as we age, Americans will spend more of our hard-earned retirement assets on health care, such as insurance, prescription drugs, in-home care and other services that help us remain independent,” says NRMLA’s President Steve Irwin. “A retirement plan that includes the responsible use of home equity may be the best option that can help ensure healthcare spending doesn’t become a financial burden for many retired couples.”