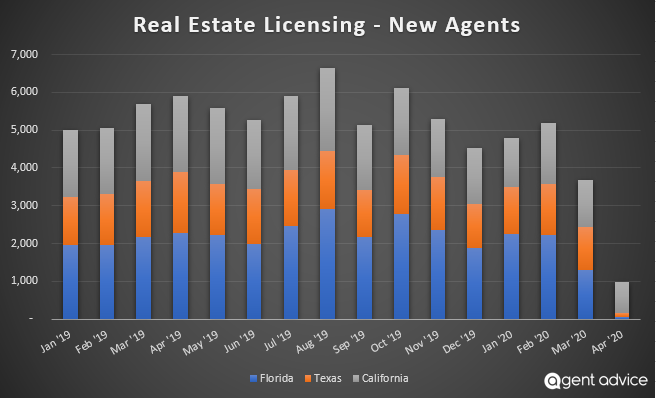

An analysis of recent real estate licensing trends released by Agent Advice this week reveals that licensing rates are beginning to recover from a precipitous drop caused by COVID-19 in March and April.

Data pulled from California, Texas, and Florida (which together capture 36% of real estate licensees in the United States) indicates that prospective real estate agents, and the real estate industry as a whole, experienced a collective slow-down in March and April as COVID-19 began to spread across the United States. New home listings dropped by 44%, creating significant uncertainty among prospective agents about whether the timing was right to begin a real estate career. And of course, local and state “stay-at-home” orders further increased this uncertainty, as many State Real Estate Commissions experienced closures of their own that impacted new agents’ ability to get a real estate license.

As a result, the issuance of new licenses crawled to a halt in April. In California, new licenses issued dropped by 59%. In Texas, they dropped by a staggering 94%. And in Florida, things came to a near standstill, slowing down by more than 97% vs. the prior year.

Thankfully, May, June, and July brought a strong recovery as agents (and the market more broadly) adapted to the new normal. Even with the recovery, new licenses year to date are still down by 29% in Florida and 12% in Texas (California data from July was not available at the time of publication). That said, average monthly licensing rates are trending upwards and are likely to soon recover back to pre-COVID levels.

Despite the COVID-19 driven starts and stops in licensing, the overall number of new Realtors has continued to grow year over year. According to the National Association of Realtors, there were 1,409,727 members at the end of this July, up 1.9% from the same time the prior year. And even just comparing July to June, the count has grown by almost 1% – a good sign that prospective agents are beginning to recover their confidence in the market and seek their licenses.

Chris Heller, real estate industry veteran and member of the Agent Advice Editorial Board, puts it simply: “I can tell you that although some agents left the industry when the market saw weakness earlier this year, others used the disruptions caused by COVID-19 as a springboard to start a new career in real estate. The best agents are those that don’t let temporary market fluctuations disrupt their career trajectory, but instead use them as opportunities to improve their skills and prove to their clients that they are a trusted advisor, even when things get tough.”

This column does not necessarily reflect the opinion of HousingWire and its owners.

To contact the author of this story:

Jasen Edwards at [email protected]

To contact the editor responsible for this story:

Sarah Wheeler at [email protected]