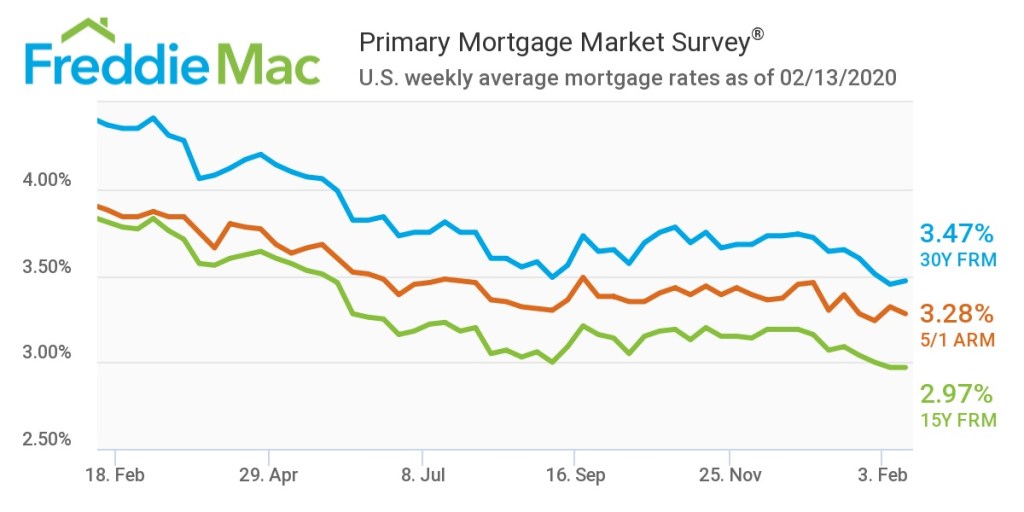

The average U.S. fixed rate for a 30-year mortgage inched up to 3.47% this week, reversing course from last week’s 3-year low of 3.45%.

Although this week’s rate is just two basis points above the previous week’s rate, it is still 90 basis points below the 4.37% of the same week last year, according to Freddie Mac.

Sam Khater, Freddie Mac’s chief economist, said mortgage rates continue to hover near historic lows, which is providing a boost to housing and mortgage demand.

“With mortgage rates hovering near a five-decade low, refinance application activity is once again surging, rising to the highest level in seven years,” said Khater. “This surge coupled with strong purchase activity means that total mortgage demand remains robust, reflective of a solid economic backdrop and a very low mortgage rate environment.”

According to the survey, the 15-year FRM averaged 2.97% this week, holding steady from last week’s rate. This time last year, the 15-year FRM came in at 3.81%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.28% this week, sliding from last week’s rate of 3.32%. Last year, the 5-year ARM averaged 3.88%.

The image below highlights this week’s changes: