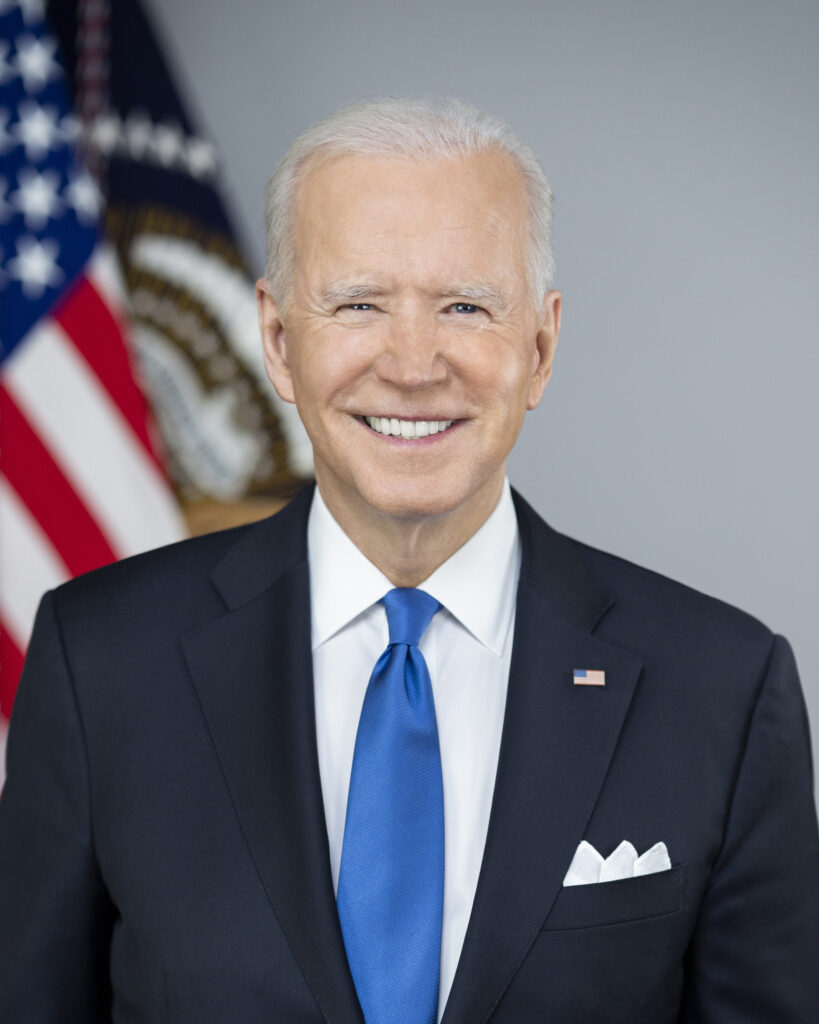

While specific action from Congress on the topic of the Home Equity Conversion Mortgage (HECM) program remains unlikely due to the current climate in Washington, D.C., other major initiatives being actively spearheaded by Congressional Democrats and by the administration of President Joe Biden could have an impact on many reverse mortgage-adjacent issues affecting industry professionals and the senior demographic at-large. Chief among these is an infrastructure plan currently being promoted by the White House.

However, the White House is also delayed in submitting a new budget proposal to Congress, which would give reverse mortgage industry participants and stakeholders a much clearer idea of where the Home Equity Conversion Mortgage (HECM) program sits within the priorities of the current administration. Until a proposal is unveiled, it will be difficult to determine the administration’s housing priorities and general view of necessary HECM-related action.

This is according to a panel discussion on 2021 legislative priorities in Congress which took place at the National Reverse Mortgage Lenders Association (NRMLA) Virtual Policy Conference last month.

The infrastructure plan

Known primarily as the “American Families Plan,” President Biden has spearheaded this legislation as another sizable spending bill with $1 trillion in new spending, and an additional $800 billion in tax credits.

A lot of the spending is targeted at expanding access to education and child care, including financing for universal pre-kindergarten, a federal paid leave program, moves which would reduce the cost of childcare, subsidized community college for anyone seeking higher education, financial aid for students at colleges that historically serve communities of color, expansion of the Affordable Care Act and new, targeted efforts aimed at combating poverty, according to the New York Times.

As previously detailed by a political professional who has lobbied on behalf of the reverse mortgage industry, the general busyness and political polarization in Congress likely makes targeted changes for the HECM program unlikely in the near-term, but that’s not to say that elements of the sprawling new infrastructure package will be without any relevance to the reverse mortgage industry.

“Among many items, [the American Families Plan] is going to include funding for elder care, childcare, parental and emergency leave, free community college, etc,” said Melody Fennel with Fennel Consulting in Arlington, Va. at the Virtual Policy Conference. “It’s expected to top a trillion dollars in cost and would be paid for by a series of tax increases, this time on the individual side of the tax code.”

Housing relevance of the infrastructure package

Officials from the administration with more direct relevance to housing have also aimed to try and reframe what “infrastructure” as a concept means in modern America, up to and including U.S. Department of Housing and Urban Development (HUD) Secretary Marcia Fudge.

“At some point, you realize that infrastructure is a foundation,” Secretary Fudge said in a video message released by the White House in late April. “Housing is one of the most important foundations that any family, or any person has. 11 million or so people in this country are paying more than 50% of all of their income towards rent. That is not affordable. ‘Affordable’ means I can live decently, and do all the other things that are necessary for me to have a decent life.”

Secretary Fudge also discussed the necessity of expanding the availability of broadband internet access to rural communities, citing the necessity created by the COVID-19 coronavirus pandemic for more people to have the ability to work effectively from home.

Of course, the true measure of the HECM program and where it stands in the priorities of the new administration will be more fully realized when the White House unveils its budget proposal for 2022. In February 2020, the administration of President Donald Trump released its final budget proposal which shed light on HECM program priorities at that time.

These included proposals which would permanently remove the limitation placed on the number of HECM loans that can be insured by the FHA; a waiver of the HECM counseling requirement; an update the actuarial analysis that FHA uses to determine the adequacy of its HECM insurance premiums; and an imposition of area lending limits to replace the current national lending limit.

Biden budget proposal is still forthcoming

As of mid-May, the White House under President Biden has yet to release a budget proposal, which is necessary to determine the position of the HECM program in the administration’s housing priorities. This is also complicated by the fact that there was a relatively recent presidential transition, which further obfuscates how the Biden White House may view certain programs – including HECM – when directly compared with its Trump predecessors.

“It starts with OMB and the president’s budget, which is substantially delayed this year for a variety of reasons, some political, some strategic,” said David Horne, a government relations expert and former chief of staff for HUD under Secretary Steve Preston in the final months of the George W. Bush administration. “And when that gets unveiled, we will know better where the HECM program is, because there’s an important attribute, which is whether it makes money breaks even or loses money.”

As previously posited by Scott Olson at the Virtual Policy Conference, Horne concurs that the likelihood of HECM program movement – or even movement on broader FHA programs – is relatively minimal.

“I think in all likelihood, we may see little or no legislation affecting us on the FHA program, or FHA programs broadly, in part because there doesn’t seem to be a huge crisis in housing,” Horne said. “And additionally, because of Senate and House processes, any big items can only go through what is now known as the ‘reconciliation process,’ and which we’ve seen with the last successful legislation to be signed by the president.”