Recent market trends — including an improvement in mortgage rates, housing affordability and potential refinance opportunities — suggest positive signs for the real estate market this year, according to February’s Mortgage Monitor report from Intercontinental Exchange (ICE).

Mortgage rates held at 6.71% as of Jan. 24, down more than a full percentage point since their peak in October, the report noted. The spread between the 30-year fixed mortgage rate and the 10-year Treasury yield narrowed to 253 basis points (bps) on Jan. 24, falling 18 bps since early January and down about 50 bps from August.

On HousingWire’s Mortgage Rate Center, the 30-year conforming fixed mortgage rate was at 6.908% as of Feb. 5.

The ICE Home Price Index for December reported an annual growth rate of 5.6%, up from 5.1% in November, which at first glance suggests an accelerating housing market.

This acceleration, however, is a residual effect of last spring and summer’s strong run of growth, with more recent data suggesting that the growth rate will begin to cool in the coming months, the report noted.

The seasonally adjusted monthly growth rate of home prices picked up from 0.09% in November to 0.13% in December. But price appreciation remains cool, falling 0.42% in the month on a non-adjusted basis, well below the 25-year December average of -0.08%.

Refinance Incentive

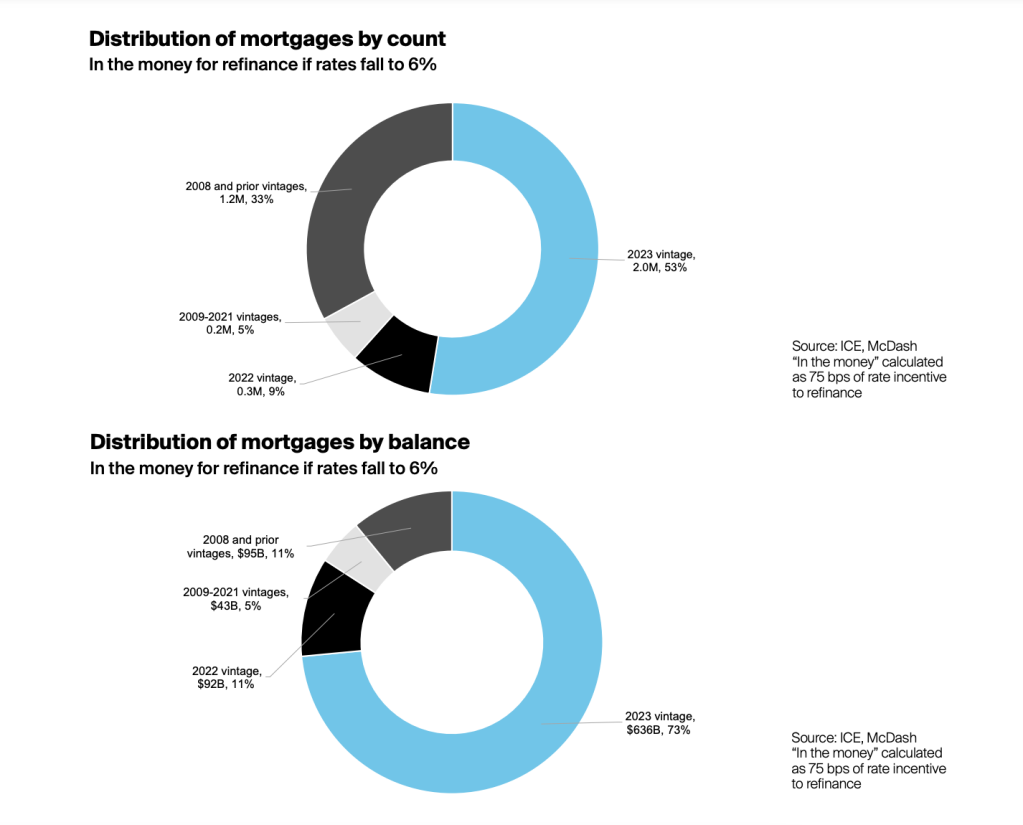

Lower interest rates have also begun to slowly increase refinance incentives for existing homeowners, particularly among the 4.3 million mortgages originated in 2023.

Of the 2023 vintage, 2 million of these borrowers (or 26%) would be able to cut their first-lien rate by 75 bps if 30-year rates fall to a projected 6% by the end of 2024, with 33% able to save a full percentage point or more.

“Under that scenario — a potential needle mover for the refinance market — some 46% of 2023-vintage borrowers would be ‘in the money,’ with nearly a third able to cut a full percentage point off their current rates,” said Andy Walden, ICE vice president of enterprise research strategy.

If 30-year rates fall to 6% by the fourth quarter, as the Mortgage Bankers Association (MBA) and Fannie Mae are currently predicting, the overall population of loans with a 75-bps refi incentive would more than double from 1.7 million to 3.8 million. Nearly 60% of that growth would come from loans originated in 2023, ICE projected.

Under such a scenario, more than half would be homeowners who financed in 2023, with less than 10% coming from 2022-vintage loans.

Another one-third would be borrowers who took out loans more than 15 years ago and did not refinance when rates dipped below 3%, making them unlikely to refi at 6%.

Home affordability

ICE noted that home affordability has improved in recent months despite a modest upward tick in mortgage rates over the past few weeks.

Homeowners are required to make a monthly payment of $2,257 to purchase the median-priced home, assuming the use of 30-year fixed-rate loan and a 20% down payment. That figure is down $243, or nearly 10%, from a record in October, but up $831 (58%) from the start of 2022.

At 33.4% of the median household income, the average payment is down from a 38-year high of more than 38% in October.

But that number is still 9 percentage points above the 30-year average debt-to-income ratio of 24.2% and slightly less than the 33.8% peak prior to the housing market downturn in 2006.

“If current industry rate forecasts come to fruition, affordability will gradually improve as we move through 2024 but continue to run well over long-run averages throughout the year,” the report stated.

Equity levels

Mortgage holders ended 2023 with $16 trillion in equity, the highest year-end total on record, and up $1.6 trillion, or 11%, compared to the end of 2022.

About $10.3 trillion of this total is considered “tappable,” meaning it can be withdrawn while maintaining an 80% or lower combined loan-to value (CLTV) ratio. This number rose by 12%, or $1.14 trillion, in 2023.

The average mortgage holder now has $299,000 in equity, up from $274,000 at the end of 2022. This equates to an average of $193,000 in equity that could be withdrawn while still maintaining a 20% equity stake in their home.

“Historically high levels of equity continue to help insulate mortgage investors from potential losses and create the conditions for an upswing in equity lending when interest rates ease enough to make withdrawals more attractive to homeowners,” according to the report.