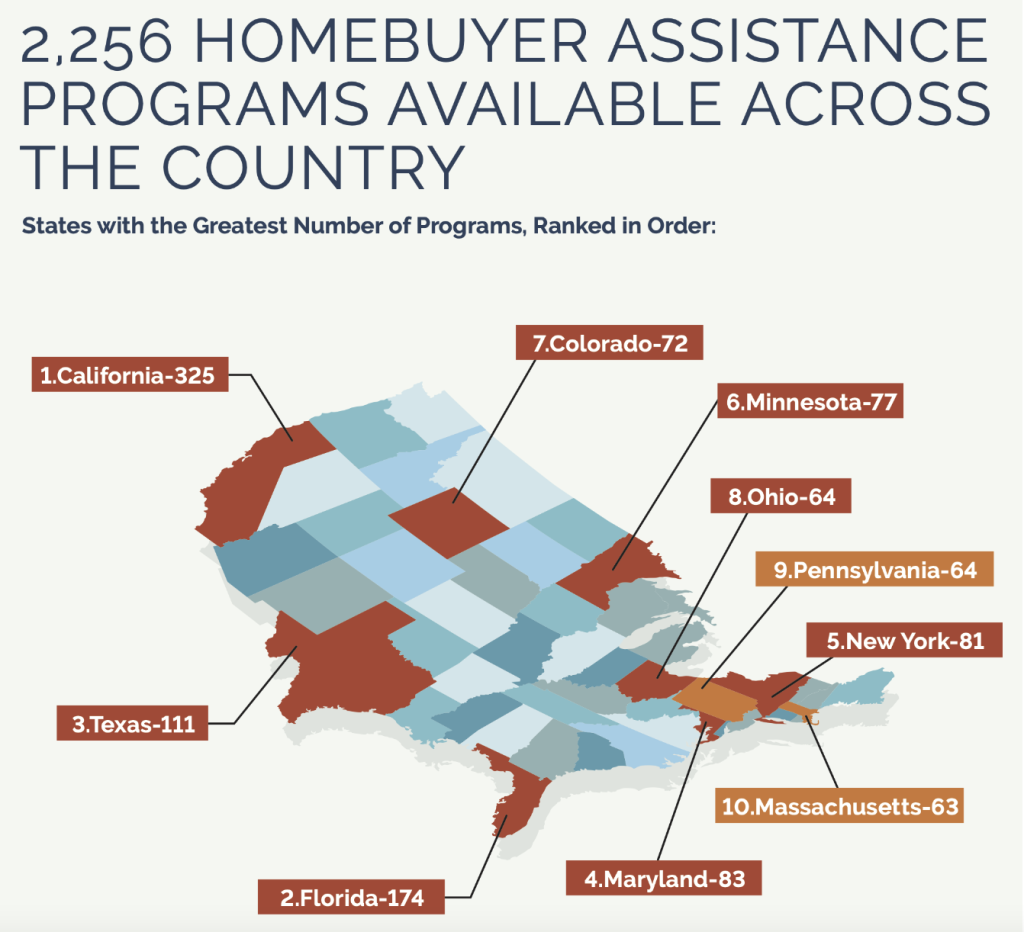

A total of 2,256 homebuyer assistance programs are available in the U.S. housing market after 54 programs were added in the third quarter, according to Down Payment Resource (DPR), a homebuyer assistance program data and solutions firm.

Among the available homebuyer assistance programs were 295 that allow borrowers to lower their interest rates by paying an upfront fee, according to DPR’s homeownership program index report.

“Program providers are working around the clock to ensure the programs they offer meet the needs of their markets. For this reason, many programs now allow funds to be used for buydowns and other popular financing strategies that take the edge off of monthly mortgage payments,” Rob Chrane, founder and CEO of DPR, said in a statement.

Of the 295 programs, 253 will fund permanent buydowns and 66 will subsidize temporary buydowns. Buydowns have become a preferred financing strategy for borrowers as mortgage rates have surged.

In a permanent buydown, borrowers’ interest rate is lowered by a certain percentage for the entire duration of the mortgage. A temporary rate buydown on a mortgage allows homebuyers to reduce their interest rate for a limited period, usually a year or two.

A total of 224 programs will fund certain upfront loan fees including the upfront mortgage insurance premium on FHA loans, the funding fee on VA loans and the guarantee fees on USDA loans.

Up to 71 programs will fund mortgage insurance buydowns – which is required for all borrowers of FHA loans and conventional loans with a down payment of less than 20% of the purchase price.

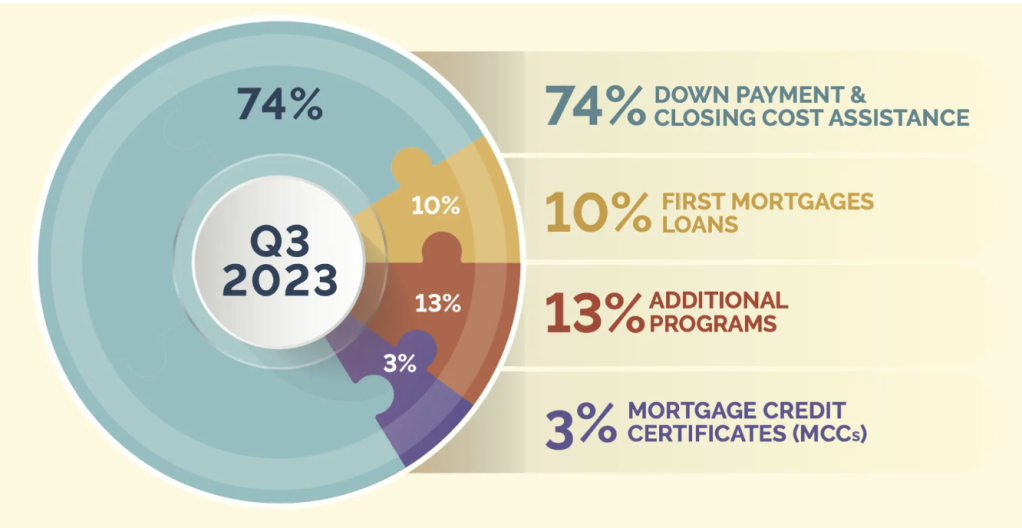

About 74% of the 2,256 homebuyer assistance programs are down payment and closing cost assistance programs. Some 10% of the programs are first mortgages and 3% of programs are mortgage credit certificates (MCCs).

A growing number of non-bank mortgage lenders have rolled out down payment assistance programs recently to increase their origination pie in a challenging mortgage environment.

Most recently, loanDepot rolled out a new down payment assistance program for FHA loan borrowers that enables them to put zero money down upfront.

Other lenders that introduced down payment assistance programs include Rocket Mortgage, United Wholesale Mortgage, Guild Mortgage and Guaranteed Rate.

Across the country, California (325) offered the greatest number of homebuyer assistance programs, followed by Florida (174) and Texas (111).