The Federal Housing Administration’s recently announced first look program for foreclosed property auctions is a welcome innovation that should help boost a trend that has been developing over the past decade: more foreclosed homes getting into the hands of owner-occupants and fewer getting into the portfolios of large-scale single family rental operators, often backed by Wall Street.

Some might be surprised to hear about this trend toward higher owner-occupancy rates for foreclosed homes. It is counter to a popular and politically potent narrative grounded in the aftermath of the Great Recession, when large institutional investors scooped up thousands of properties at foreclosure auction.

This narrative was once again repeated in the HousingWire article announcing the FHA first-look program: “Typically, FHA-insured foreclosed properties are snatched up by large investors and turned into rental properties.”

But proprietary data from Auction.com and public record data clearly show this oft-repeated narrative is yesterday’s news.

Net owner-occupancy rates

Among nearly 135,000 properties foreclosed between 2016 and 2020 that sold to third-party buyers at foreclosure auction on the Auction.com platform, more than half (54%) are owner-occupied as of 2022, according to public record county tax assessor data from ATTOM Data Solutions. That compares to a 49% owner-occupancy rate for more than 190,000 properties that reverted back to lenders at foreclosure auction. Most of these reverted REOs are eventually sold via the Multiple Listing Service (MLS).

The data paints a similar picture specifically for foreclosed properties backed by FHA-insured loans, the subject of the recently announced first-look program. Over the same period (2016 to 2020), the net owner-occupancy rate for FHA foreclosures sold via auction was 57% compared to 50% for FHA foreclosures sold on the MLS.

The higher owner-occupancy rate for distressed properties sold at auction than those sold on the MLS is a surprising stat given that the MLS is much more broadly known to retail, owner-occupant buyers.

The role of renovators

A deeper dive into the data helps to explain this surprising result. While most distressed properties sold at foreclosure auction don’t go directly to owner-occupant buyers (the reasons for that have recently been well-explained by Urban Institute research), many end up with owner-occupant buyers by way of local investors who renovate distressed properties into a condition that is attractive and financeable — but still affordable — for owner-occupants.

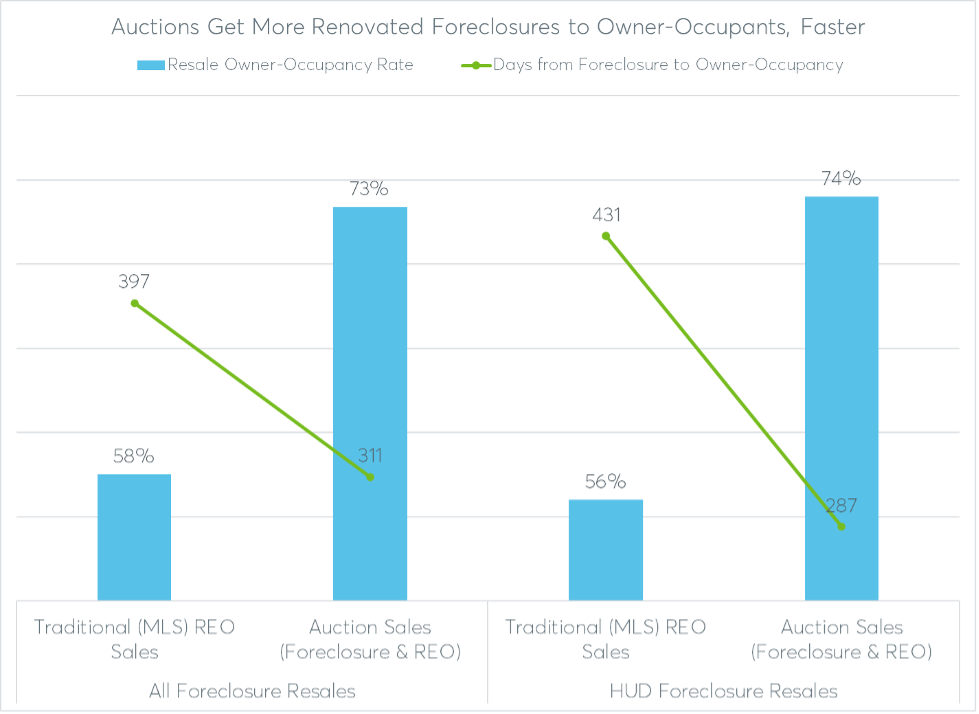

Among more than 73,000 properties sold to third-party buyers at foreclosure auction between 2016 and 2020 and then subsequently resold into the retail market, 73% (more than 53,000) were sold to owner-occupant buyers, according to the public record data. That compares to a 58% owner-occupancy rate for more than 121,000 properties that resold on the retail market after reverting back to the lender at foreclosure auction during the same period.

It turns out local investors are also more efficient than banks and government agencies at renovating and reselling homes. The local investors resold their renovated homes to owner-occupants an average of 311 days after the foreclosure auction, about three months faster than the average 397 days it took to resell renovated REO homes.

Again, the trends are similar for foreclosed properties securing FHA-insured loans: a resale owner-occupancy rate of 74% among properties purchased at foreclosure auction by third-party buyers compared to a resale owner-occupancy rate of 56% among those that reverted to the lender at the foreclosure auction.

Among the FHA foreclosures, local investors resold their renovated homes an average of 287 days after the foreclosure auction, nearly five months faster than the 431 days on average to resell renovated REOs.

I buy local

But what about the foreclosed properties that don’t end up in the hands of owner-occupants? Are those going to “large investors” building single family rental empires, as claimed by the popular narrative?

Once again, the data clearly points to this narrative being outdated.

Nearly 100% of Auction.com buyers in 2021 (99%) purchased 10 or fewer properties during the year, and 79% purchased just one property. The 99% of buyers accounted for 89% of all properties purchased during the year.

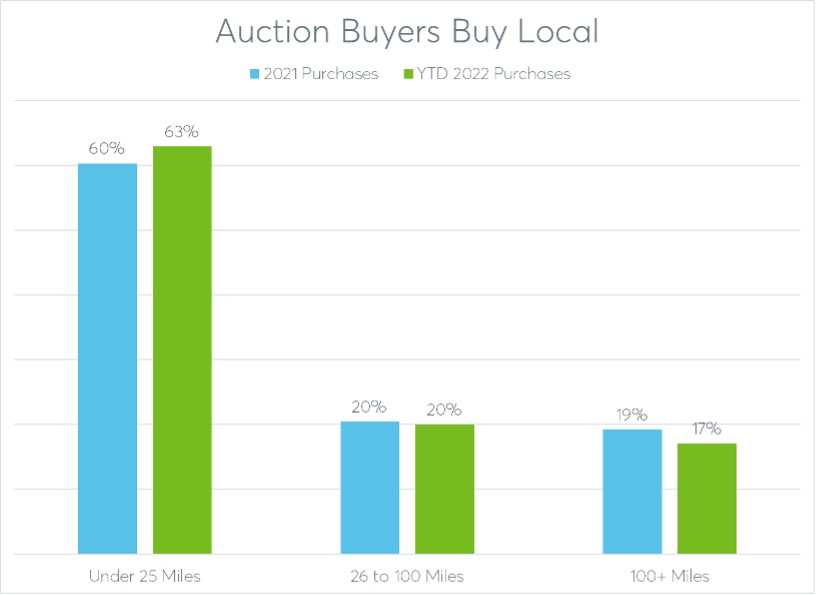

Furthermore, 83% of all purchases on the auction site in 2021 were made by buyers who lived within 100 miles of the property purchased, while 63% were by buyers who lived within 25 miles. The median distance between buyers and properties purchased was just 17 miles.

This data paints a much different picture of the typical foreclosure auction buyer than that painted by the popular narrative. These are not multi-state institutional investors purchasing hundreds of properties a year at foreclosure auction. These are local investors buying a few properties in communities where they live and work.

Bye-bye bulk buyers

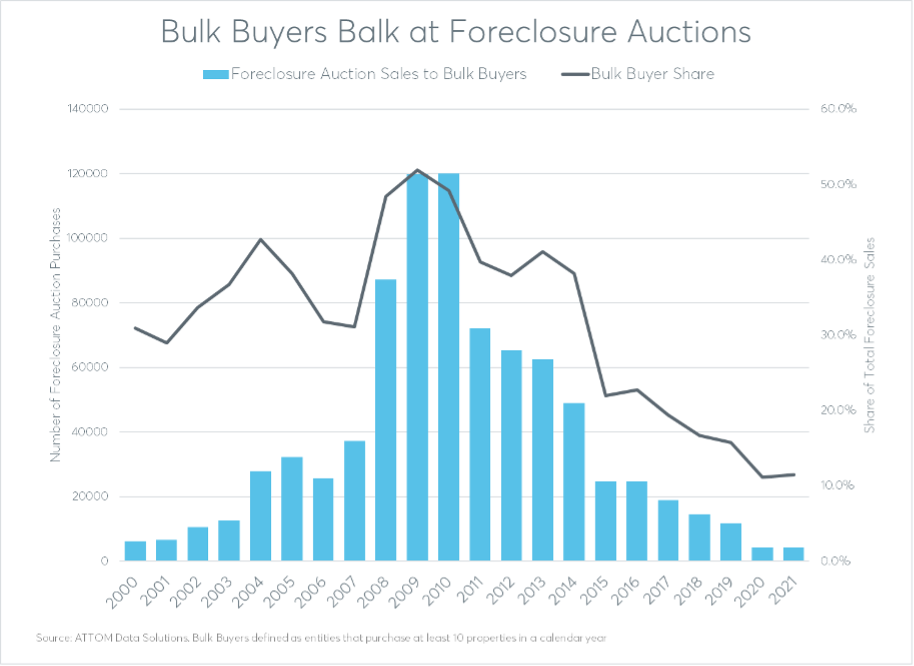

The popular narrative about foreclosure auction buyers is grounded in truth; it’s just truth from more than a decade ago. Public record data looking at the total foreclosure sales market demonstrates this. In 2009, at the peak of the Great Recession’s foreclosure crisis, more than half (52%) of all foreclosure sales were sold to entities who purchased at least 10 properties in a calendar year, according to data from ATTOM Data Solutions.

But that share has gradually shrunk over the last 12 years. In 2020 and 2021, only 11% of total market foreclosure sales went to entities who purchased at least 10 properties in a calendar year.

Broader buyer spectrum

The 11% of 10-plus property buyers in the total market is likely higher than the 1% on Auction.com for a couple reasons. First, site’s data is only looking at the number of properties purchased on the platform while the public record data is looking at total properties purchased.

Secondly, properties sold through the auction platform are more visible and accessible to a broad spectrum of buyers than are properties sold through the traditional foreclosure sale model. In that model, the only marketing of foreclosure auctions is through notices in a local newspaper or legal publication.

This technology-enabled transparency is creating equal opportunity for more buyers, including smaller-volume local investors who can now better compete against the large-volume institutional investors.

Daren Blomquist is vice president of market economics at auction.com.