Mortgage lenders are finally feeling optimistic about the business, according to Fannie Mae’s latest sentiment survey.

For the first time in nearly three years, senior execs at major lending institutions reported a positive outlook in net profit margins, with most citing increased consumer demand as the main reason, followed by operational efficiency.

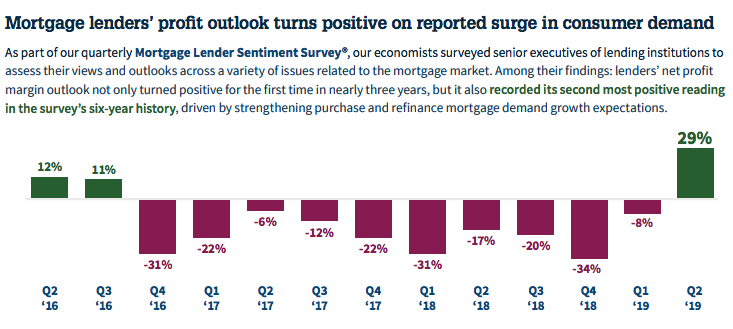

With 29% of respondents reporting a positive outlook, the second quarter’s findings were the second most positive reading since the survey began in 2014, Fannie revealed. (See chart below, courtesy of Fannie Mae.)

“Lenders are signaling strong demand-driven mortgage market dynamics, with optimism for both their consumer demand and profitability outlooks reaching multi-year highs,” said Fannie Mae Senior VP and Chief Economist Doug Duncan.

For those who reported a decreased profit margin outlook, competition from other lenders was cited as the top reason, followed by staffing.

Lenders also reported strong growth in purchase mortgage demand, with the net share of those reporting purchase growth rising significantly from last quarter. Expectations for purchase demand growth in the next three months also spiked for both GSE and non-GSE loans.

Growth in refinance demand was also strong. For the first time in nine quarters, lenders reported positive demand growth for refinances across all loan types, Fannie revealed. Expectations for refi demand in the next three months also turned positive for the first time in two-plus years.

“Lender sentiment regarding both recent and expected purchase mortgage demand growth across all loan types was the most upbeat in at least three years,” noted Duncan. “And for the first time in more than two years, lenders who are reporting or expecting growing refinance demand became the majority.”

Lenders also reported that the easing of credit standards is trending downward, with easing on GSE and government loans declining to the lowest level in five years.

Duncan said that the results indicate that any meaningful easing of lending standards is “a thing of the past.”

He also said that while increased optimism among lenders was a positive development, there are still hurdles impeding mortgage lending activity.

“A lift in lender sentiment from depressed levels is an encouraging sign,” Duncan said, “however, many challenges remain, including the continued shortage of entry-level housing.”