In today’s competitive housing market, there are many factors that help determine whether a person is ready to buy – rather than rent – their next home.

To better understand the profile of individuals who are taking the next step in their financial journey, we researched how previous financial milestones impact the readiness to open a mortgage among Millennials – the rising generation of homeowners. Then, we explored what behaviors can help or hinder consumers’ credit scores once they have made the leap into homeownership.

For young consumers, student loan debt can delay the journey to homeownership

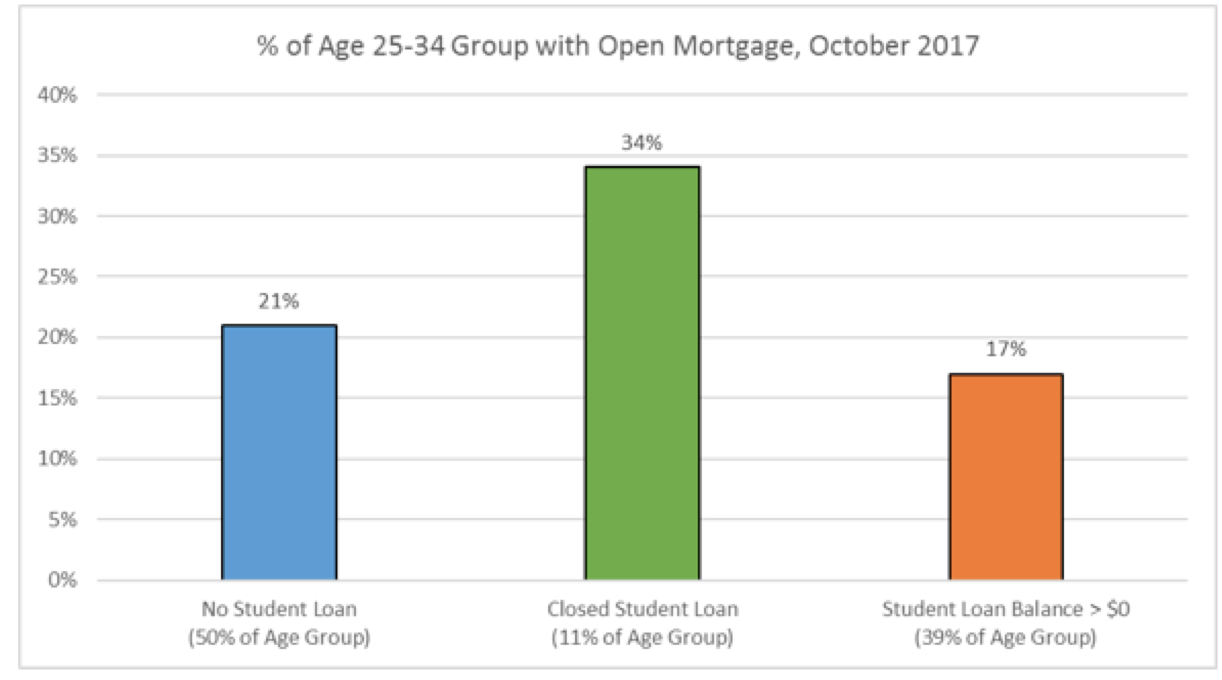

As part of a broader study examining important milestones in a consumer’s financial journey, we recently studied the impact of Millennials’ (ages 25 to 34) student loan debt on their willingness and ability to obtain new mortgage loans.

What we found by bridging the journey from one stage in the credit life cycle (repayment of student loans) to another (taking out a mortgage), was that the 11% of Millennial consumers with closed student loans had an open mortgage, while about 50% without any student loan history on their credit file. Notably, the active student loan debt population is half as likely to have an open mortgage than those with closed student debt loans.

Click to Enlarge

(Source: FICO)

A possible explanation for this may be consumers’ fear of outspending their income. Young consumers continuing to pay down their student loans may be less inclined to open a mortgage until they sufficiently increase their income or rid themselves of their student loan burden.

Notably, there is a correlation between consumers’ average FICO score and the rate of homeownership. Millennial consumers with only closed student loans on file score on average some 40 points higher than those with no student loans on file. Those with active student loan debt score slightly lower than those with no student loans on file.

Credit behaviors to prepare your credit score for homeownership

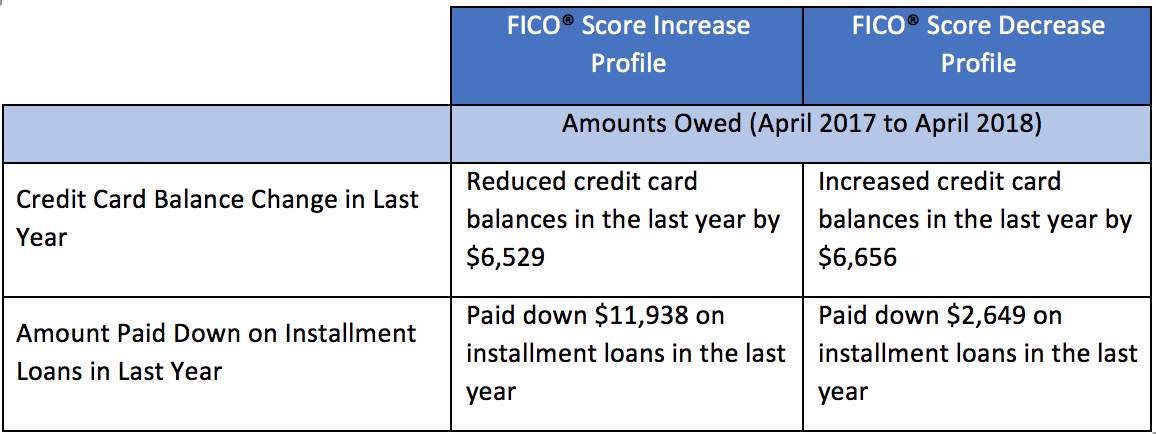

Building off of our millennial research, we studied the credit behavior of people with new mortgages to determine which behaviors are driving FICO Score increases and decreases.

We used a nationally representative sample to identify roughly 2.8 million consumers with a newly opened mortgage between May 2017 and July 2017 to explore and contrast the credit behaviors of consumers that experienced a score increase and those that experienced a score decrease in the year after opening a new mortgage.

We looked at credit behaviors of these two groups of consumers across a variety of dimensions such as amounts owed, on-time payments and searches for new credit.

Our key findings reveal:

- Consumers with a FICO score increase are more likely to reduce their amounts owed. “Amounts owed” makes up about 30% of the FICO score calculation.

- Consumers with an increase in a FICO score reduced credit card balances by 49%, while those that had a score decrease increased their credit card balances by 97%. Over the course of a year, consumers with an increase in a FICO score on average paid down their installment loans at a rate three times greater than that of consumers that had a decrease in score.

Click to Enlarge

(Source: FICO)

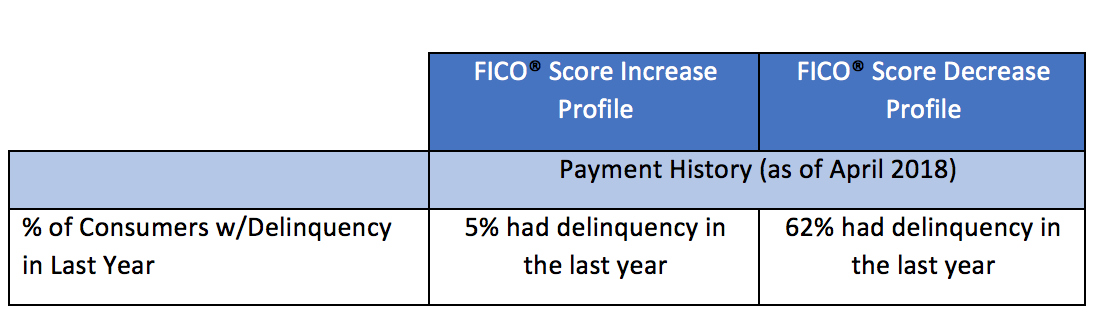

- Consumers with a decrease in FICO score were much more likely to have had a missed payment in the past year. “Payment history” is the most important category within the FICO score, comprising about 35% of the total score calculation.

Click to Enlarge

(Source: FICO)

- Consumers that apply for more new credit are likely to experience a score decrease. The number of inquiries associated with a consumer applying for credit increased 22% for those with a FICO score decrease, while for consumers who experienced a FICO score increase, inquiries decreased by 21%.

As the data and research have shown, credit behavior doesn’t discriminate based on life stage. No matter where consumers are their financial journey, homeowners, and those in pursuit, will benefit from best practices including, paying their bills on time, paying down debt and applying for credit less frequently.