National rents are on the rise to the tune of 1.4% year-over-over. The coast hold the highest concentrations of rent growth titans, but mirror, mirror on the wall, California is far and away the most expensive state of them all.

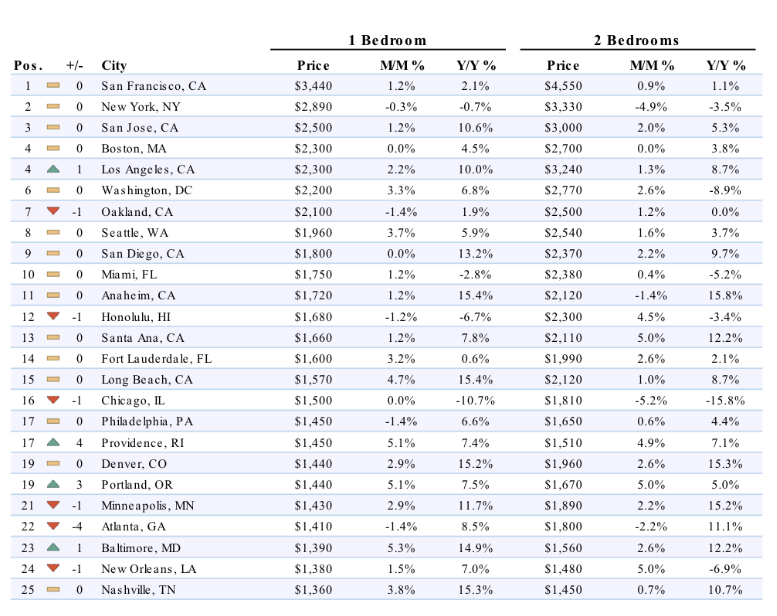

According to Zumper, a rental listing site, three of the top five most expensive rental markets in the nation are in California. San Francisco holds the top spot as the nation’s priciest multifamily market exhibiting rent growth of 1.2% in its one-bedroom price to $3,440. San Jose came in third at 2,500 for a one-bedroom, and Los Angeles tied with Boston for fourth place at $2,300 for a one-bedroom apartment.

New York holds the second-place berth at $2,890 for a one-bedroom unit, though it fell .30% month-over-month and .70% year-over-year.

The top 10 markets remained largely unchanged with the exception of Los Angeles which cranked up its rent growth rate to 2.2% month-over-month and a staggering 10% year-over-year, catalyzing its climb from the five spot to share the fourth spot with Boston.

Here’s the full, top 10 list:

1. San Francisco

2. New York

3. San Jose

4. Boston

4. Los Angeles

6. Washington D.C.

7. Oakland

8. Seattle

9. San Diego

10. Miami

California is exhibiting rapid year-over-year rent growth with three cities in the state at 10% or more growth year-over-year. Looking a little further down the list, Anaheim and Long Beach are at over 15% rent growth year over year. There are only a handful of cities in Zumper’s top 100 outside of California with over 15% rent growth for one-bedroom units. To put it in perspective, Las Vegas and Houston have the highest rent growth year-over-year at 15.60%. Anaheim and Long Beach are both at 15.40% the second highest growth rate recorded in the report.

Here is a longer excerpt from the report; to view the whole report, click here.