While the nation’s eyes may be focused on just a few states right now, come Nov. 3, 2020, all anyone will be talking about will be the blue states versus red states.

When the election results start rolling in that night, all the states on all the TV networks’ maps will be turned red or blue and we’ll be on our way to either four more years of the Trump administration or four years of someone else.

And while each state will have its moment in the sun between now and November, the race to win the Electoral College isn’t the only competition that matters to the red states and the blue ones too.

There’s also the issue of which states will have the hottest housing markets this year. And a new report says that it’s going to be better to live in “Trump country” this year than the “coastal elite states,” at least from a housing perspective.

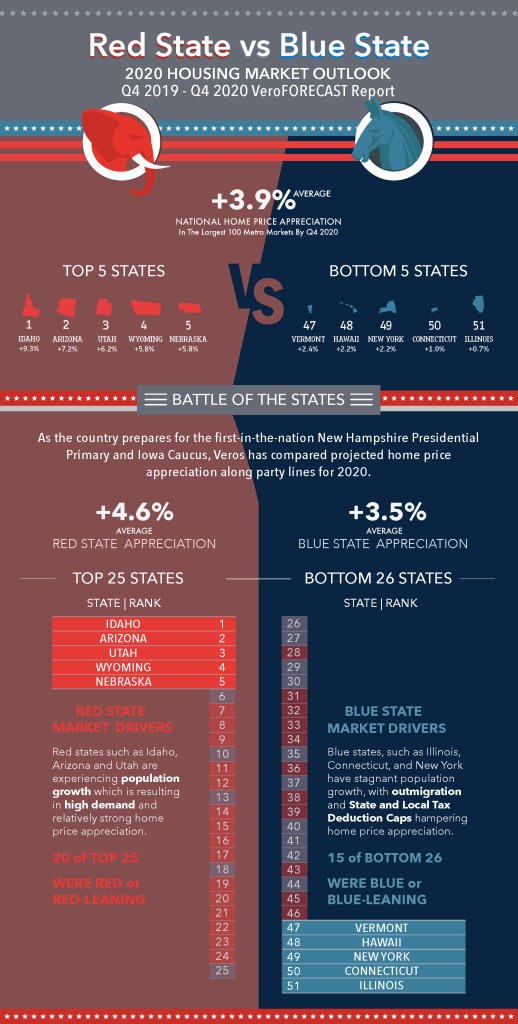

Veros, an enterprise risk management and collateral valuation services provider, released a report this month showing that nationwide, home prices in the largest 100 markets are expected to rise an average of 3.9% from the fourth quarter of 2019 through the fourth quarter of 2020.

But there are quite a few states where prices are expected to rise more than that, and as it turns out, most of them are red states.

Overall, according to Veros’ research, the average home price appreciation in blue states is expected to be just 3.5% in the next year, lower than the national average.

Meanwhile, the average appreciation for red states is projected to be more than a full percentage point higher than the national average, 4.6%.

Beyond that, the five states where home prices are expected to rise the most are all red states.

The top five states for home price appreciation over the next year are Idaho, where home prices are expected to rise by 9.3%; Arizona, where home prices are expected to rise by 7.2%; Utah, where home prices are expected to rise by 6.2%; Wyoming, where home prices are expected to rise by 5.8%; and Nebraska, where home prices are also expected to rise by 5.8%.

In fact, according to Veros, twenty of the top 25 states with strong home price appreciation are red or red-leaning states. Meanwhile, for the bottom 26 states (including the District of Columbia), 15 of those were blue or blue-leaning states.

Going a step further, the five states where home prices are expected to rise by the smallest amount are all blue or blue-leaning states.

The five states with the lowest projected home price appreciation are Vermont, where home prices are expected to rise by 2.4%; Hawaii, where home prices are expected to rise by 2.2%; New York, where home prices are expected to rise by 2.2%; Connecticut, where home prices are expected to rise by 1%; and Illinois, where home prices are only expected to rise by 0.7%.

According to Veros, this dichotomy is partially caused by stagnant population growth in many blue states, including Illinois, Connecticut and New York. In many of those states, population growth is hampered by outmigration, with residents fleeing more expensive markets for cheaper ones.

Another factor in the low expected price growth in several of the blue states is the impact of the Tax Cuts and Jobs Act’s elimination of certain state and local tax deductions, often referred to as SALT deductions.

The tax bill placed a cap of $10,000 on SALT deductions, but several states, including New York, New Jersey, Maryland and Connecticut, have state and local tax burdens that far exceed $10,000.

According to Veros, in markets where these taxes are high, particularly in New York, New Jersey, California and Connecticut, values are flat or expected to be very slow to appreciate in 2020.

On the other hand, red states like Idaho, Arizona and Utah are seeing population growth, which is resulting in high demand and relatively strong home price appreciation.

“For years, we saw states with high population centers like California and New York dominating home price escalation,” said Eric Fox, Veros vice president of statistical and economic modeling. “We are now seeing states like Idaho and Arizona leading the way. Outmigration from the coasts to the interior of the nation is undeniable.”

So, in the competition for hottest housing markets, it looks like the red states take the cake. As for what’s going to happen in November, we have a few months to worry about that.

Stay up to date on exclusive coverage on the 2020 election’s impact on housing by signing up for HousingWire’s latest newsletter, HousingBallot. Sign up here!