As I write this, I join all of you as we isolate ourselves from our offices, family and friends. Literally just three weeks ago, I was in Los Angeles on travel to visit my daughter. The pace of change that has impacted all Americans and people around the world is unprecedented and resulted in this complete change to our nation, our lives and our future.

The good news is that we will get through this. The bad news is that until then we will have some challenging times. It was the perfect storm really: Here the industry was at the peak of success; pipelines were chock full of loans; refinances and purchases were booming as we were headed into this spring market. Our biggest challenges were in keeping our operations teams in place and trying to control our business volumes in order to simply meet the massive demand flowing in.

Remarkable really, this was mostly the case through the first two weeks of March. Since then this apocalyptic-like scenario left everyone with dropped jaws, anxiety and questioning the future. To put this in perspective, the pace of change over just a few weeks and the breadth and depth of its impact cannot be compared to anything this nation has ever experienced before.

And while there were lessons learned from the last Great Recession, the things we are learning from this experience will be invaluable as the extent of this crisis is unparalleled to anything this nation has ever experienced before.

So let’s take a look at where we are, interventions and the implications, and looking ahead.

WHERE WE ARE

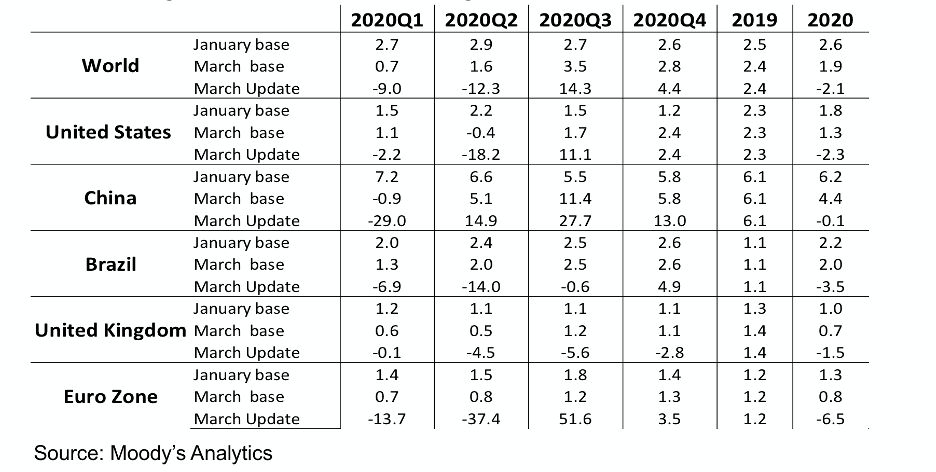

The impacts of this event are enormous in the short term. Millions of Americans are either working from home or not working at all. GDP, productivity, has dropped precipitously. Stock market volatility is risking the net worth of millions, putting Baby Boomers particularly at risk. Concerns range from families’ ability to pay rents or mortgages and other debts to questions about survival for certain businesses. But this likely won’t last too long. In fact, Moodys Analytics gave an outlook on March 27th that while the real GDP will take a massive blow for the second quarter of 2020, it should bounce back fairly quickly.

Their view (as of this presentation) is that GDP will take an 18.2% drop followed by an 11.1% increase the following quarter with steady, semi-interrupted growth from that point forward.

But in the short run, the impacts are for-reaching for the mortgage industry. Ginnie Mae MSRs lost enormous value based on forbearance concerns and liquidity implications, non-QM lending essentially stopped, co-issue has all but ended for now, FICO floors have risen to about 680 across the board and more. The Federal Housing Administration put out new requirements for pre-close VOE which calls for a paystub for the most recent pay period prior to close. In short, the credit market for mortgages is retrenching to its safest and most conservative posture reminiscent of the post-2008 period. And while this won’t last forever, it will cause slowdowns in the short run.

INTERVENTIONS AND THEIR IMPLICATIONS

The challenge for policy makers is that they are trying to steady a nation. While some of these moves will help, the cross-wind impacts can be hard. For example, in an effort to calm consumer fears, the administration announced a forbearance plan where one could merely attest that COVID-19 impacted their ability to make their home payment and they could skip several months of payments. They said that they would freeze single-family and multifamily foreclosure as long as there were no evictions during that time.

While that may have helped to calm consumer fears, it resulted in alarm and near hysteria for some mortgage companies worried about making months of advances to investors without incoming cash flow to cover it. MSR values, especially Ginnie Mae MSR’s, immediately reacted, resulting in a rash of terrible bids on pools.

Similarly, the Federal Reserve became increasingly concerned about a significant and growing supply imbalance in MBS, both for residential and multifamily. Both agency RMBS and CMBS were increasing in market supply due to the massive refinancing and the repositioning of balance sheets by bond holders given all of the rate volatility.

Without a buyer, rates could have continued to spike well above the near 5% levels we saw in early March, impairing billions of dollars in valuations of select companies. So, the Fed stepped in and significantly increased its buying of MBS.

Hooray, MBS prices modified and yields came down as the supply balanced. But the yin and yang event happened here as well. Some lenders with overly hedged pipelines suddenly found themselves faced with potentially significant pair off risk and, even worse, margin calls. In many cases, this resulted in huge timing mismatches that require significant liquidity.

For example, FHA forbearance won’t cost the servicer in the long run as these are guaranteed loans and either the borrower will begin to re-perform or the FHA insurance will make the servicer whole if the loan goes to foreclosure. It is primarily a short-term problem and when forbearance can last 180 days with a possible extension for another 180 days, this can result in an enormous need for liquidity. The same happens on the margin call risk on hedged pipelines. The long term could result in marketing gains on those same pipelines but it is the time between the mark on the hedges against the downstream gains that causes stress.

But at least Congress and the Fed have both stepped in. Congress passed the largest single bailout package in the history of the nation, one that will likely have to be followed up with another as this extends into the fall. The Fed made clear that they would keep buying with no caps in place which has resulted in the MBS price rally we have seen since this began.The key point here is that drastic measures here have benefits and downsides, but are crisis decisions and industry needs to focus on how to survive the adverse side effects. For example, pressing the Fed to establish a flexible and accessible facility for bank and nonbank lenders could significantly alleviate these concerns if done well.

LOOKING AHEAD

So what happens next? As of press time, more issues continue to unfold and there are a vast number of advocates from trade associations and elsewhere working in real time for executable solutions. For those outside the political bubble it is disconcerting. Sales teams are anxious, operators are worried about survival and whether they will be represented well in the debates over solutions, and everyone is worried about the market looking forward. While I cannot assure anyone of policy decisions to be made going forward, I can guarantee that the advocacy is aggressive and I have hope that decision makers will “get it” and put into place protections that will get the vast majority through this period.

One thing almost every economist agrees on: this event was not based on economic weakness like the last recession. The U.S. economy was very strong leading into this. Unemployment was low and credit quality was very good. Housing shortages were the challenge, and remain so, especially for entry-level housing. And when America returns to work this summer sometime, while there will be employment implications for some percentage of the workforce from this event, the GDP will have a likely quarter-over-quarter spike in improvement and the housing sector will show its extraordinary resilience. The lack of supply, the strong credit profile of the sector and the demographics have not changed.

CONCLUSION

I had originally planned an entirely different subject for this piece, but corona changed everything for you, for me and for this nation. If there is one takeaway for our industry it is to realize that this is neither the Great Recession nor the Great Depression. This is a focused and isolated event brought on by a virus.

The economic fundamentals of this nation’s economy were extremely strong just prior and will help us whipsaw back. And while it may take us through the following year or two to get back on a fully normalized course, we all need to buckle in for this roller coaster ride, realizing that when the roller coaster ride ends, it will have been relatively short, will leave us a bit dazed but we will all go back to our lives after.