The luxury real estate market had a bumpy 2019, but ended in a steady rise in luxury home prices.

In the first quarter of 2019, luxury home prices declined for the first time in almost three years, and sales saw their largest decline since 2010 as supply increased by double digits.

Luxury home prices later increased 0.3% year over year, marking the first time in nearly a year that luxury prices did not fall.

Now, there are 218 cities with a typical home value of at least $1 million, three more cities than there was in December 2018, according to a new report from Zillow.

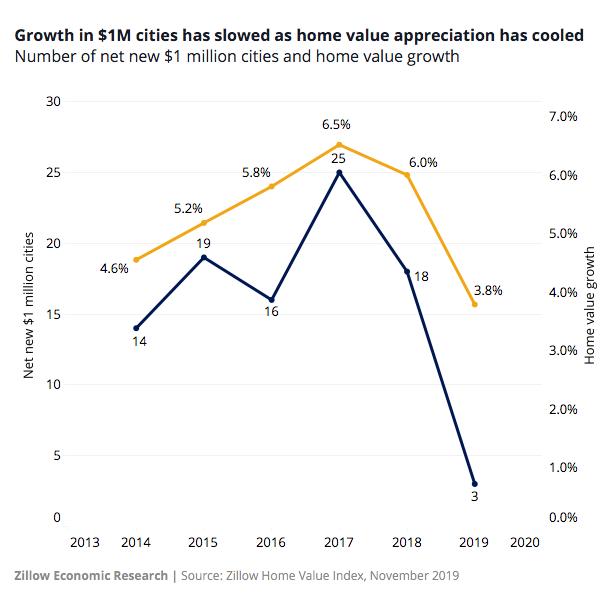

In its report, Zillow said that an average of just under 20 cities a year broke the $1 million threshold from 2014-2018, including a high of 25 in 2017 when home value growth was approaching 7% per year.

But last year was the first year since 2016 that any cities actually fell off of the $1 million list, as home values declined in some expensive areas after a period of extreme price growth.

According to Zillow, seven new cities joined the list, but four saw home values decline below the $1 million threshold in 2019, due to the slowing down market, meaning there was a net increase of only three.

This is also the first time since 2016 that any cities fell off the list.

To no surprise, more than half of the $1 million cities are in the San Francisco, New York and Los Angeles metro areas: 46 in San Francisco, 43 in New York and 30 in Los Angeles.

Boston (10 cities with typical home values of $1 million or more), San Jose (10), and Miami (7) followed suit.

The cities that joined the list of those with home values above the mythical $1 million mark throughout 2019 were Santa Ynez, California; Telluride, Colorado; Forest Hills, Tennessee; Sierra Madre, California; McLean, Virginia; Moose, Wyoming and Redondo Beach, California.

Meanwhile, San Jose, California; San Quentin, California; Lexington Hills, California and Laie, Hawaii all saw their typical home value fall below $1 million.