The nation’s low-interest-rate environment has spurred an increase in borrowing demand, as mortgage rates, which came in at 3.57% last week, continue to hover near historic lows.

As demand climbs, LendingTree, an online lending marketplace, has conducted a study to determine how many borrowers are successful during the application process.

To do so, the company delved into data from more than 10 million mortgage applications using the most recent HMDA data available for 2018.

According to their findings, nearly 1 in 10 mortgage borrowers were denied during the application process. On a national level, this means only 9.8% of loan applications were denied in 2018.

LendingTree says purchase mortgage denials are now at the lowest level since the financial crisis — and the lowest since at least 2004.

Tendayi Kapfidze, LendingTree’s chief mortgage economist, said most reasons for application denial are financial, but some are not borrower-specific, such as concerns about the collateral.

“The low denial rate is encouraging, though some of this is because the financial profile of mortgage applicants has improved. The key for homebuyers is to be well-educated on the homebuying and mortgage process,” Kapfidze said. “Understanding the key reasons mortgages are denied can help borrowers avoid missteps and compete effectively to secure their dream home.”

LendingTree’s study determined that debt and credit history were the biggest barriers to being approved for a loan. In fact, debt-to-income and credit history represented 33% and 23% of denied loans, respectively.

Additionally, collateral was the third-highest denial reason at 17%, followed by Incomplete applications at 13% and unverifiable information at 8%.

Overall the report suggests that denials varied on race, ethnicity and even geographical locations.

According to the report, African-American borrowers now have the highest denial rates at 17.4%, and Non-Hispanic whites have the lowest at 7.9%.

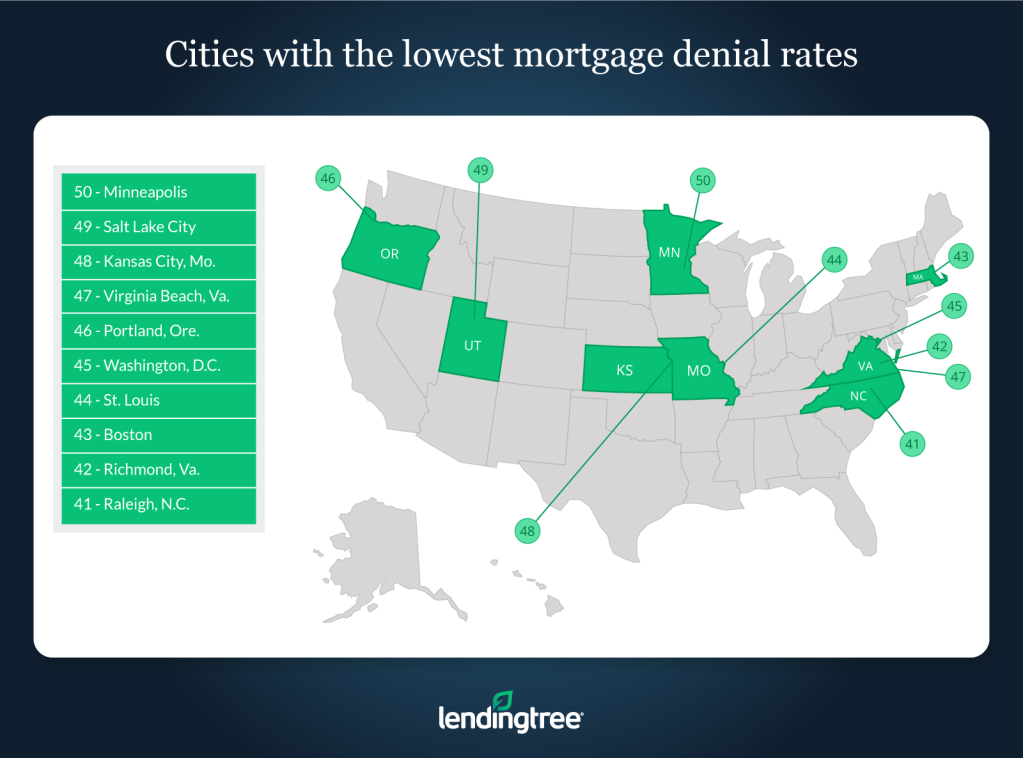

The image below highlights the housing markets with the lowest mortgage denial rates:

Note: LendingTree analyzed more than 10 million mortgage application records from the Federal Financial Institutions Examination Council’s Home Mortgage Disclosure Act 2018 data set, the most recent available. The data represents mortgage applications from over 5,000 financial institutions.