Spring buying season typically starts in February, and the resulting increase in demand traditionally causes prices to strengthen, and that’s exactly what happened this February as transaction counts increased month-over-month in 22 of the nation’s 25 metropolitan statistical areas (MSAs) tracked by Radar Logic. Home prices also improved in nine MSAs, compared to just six MSAs in February 2008. “Seasonal strength in home sales was evident in February 2009,” said RadarLogic in its RPX Monthly Housing Market Report released today. “Transactions increased…13 MSAs posted their largest month-over-month increases since 2006.” Sales in San Jose, Calif. saw the biggest year-over-year increase, climbing more than 43%, followed closely by Sacramento, and Los Angeles, Calif. In contrast, Charlotte, N.C. and Las Vegas, Nev. didn’t fare so well, as their transaction counts posted the largest drops at 56.9% and 55.7%, respectively. But month-over-month data painted a rosier picture, as only Philadelphia and Milwaukee experienced a decline in home transactions. In the closely watched California housing market, buyers appear to have returned in February, likely attracted by prices not seen since 2001 and 2002, the report said. On a year-over-year basis, the total transaction count across the five California metro areas tracked by Radar Logic increased a significant 35%. In the five California MSAs, sales outside of foreclosure jumped dramatically in February and outpaced increases in motivated sales, according to the report. As a result, motivated sales decreased as a share of total sales, though motivated sales continued to account for more than 40% of sales in each of the MSAs. Historically, since 2007, motivated sales’ share of total sales has increased in most months. Some predict the recently lifted moratoriums will cause an influx of foreclosed inventory and send home prices falling nationwide. Many of the nation’s largest mortgage servicers, including JP Morgan Chase & Co. (JPM), Wells Fargo & Co. (WFC), Fannie Mae (FNM) and Freddie Mac (FRE), have recently lifted self-imposed moratoriums on foreclosures. But Radar Logic says increasing the already large inventory of foreclosed homes “will not necessarily result in a reduction of prices from levels that are already attracting buyers in large numbers,” as indicated by elevated motivated transaction counts. “Packed auditoriums at foreclosure auctions indicate that price is not the limiting factor when it comes to selling distressed homes,” Radar Logic said. Rather, logistical and political barriers coupled with tight credit markets may be creating a bottleneck in the market. In fact, the company said the removal of moratoriums on foreclosures and sales of foreclosed homes could speed the process through which the market cleanses itself of distressed inventory, ultimately shortening the path to recovery. Write to Kelly Curran at [email protected]. Disclosure: The author held no relevant investment positions when this story was published. Indirect holdings may exist via mutual fund investments.

Home Sales Springing

Most Popular Articles

Latest Articles

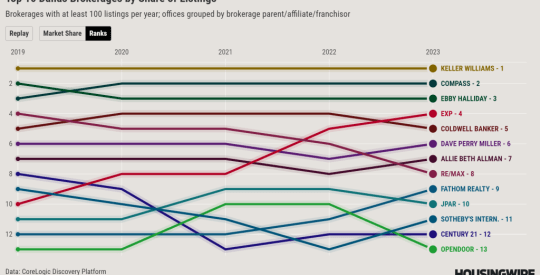

Special report: The brokerages gaining or losing market share in Dallas

Few cities have benefited as much from the trend of Americans moving south as Dallas, which added 170,000 residents in 2021 and 2022.

-

Technology’s role in rental property investment market

-

Best real estate continuing education schools for quick and easy license renewal in 2024

-

CoStar Group finds success through the sale of Homes.com memberships

-

Kevin Sears pulls back the curtain on NAR’s commission lawsuit settlement

-

A look back at HousingWire’s 2023 Marketing Leaders