iBuying appeared to make a big leap forward this year, with more companies expanding into the direct buying market seemingly every month.

But despite all the talk, iBuying only accounted for about 3% of home sales in 2019.

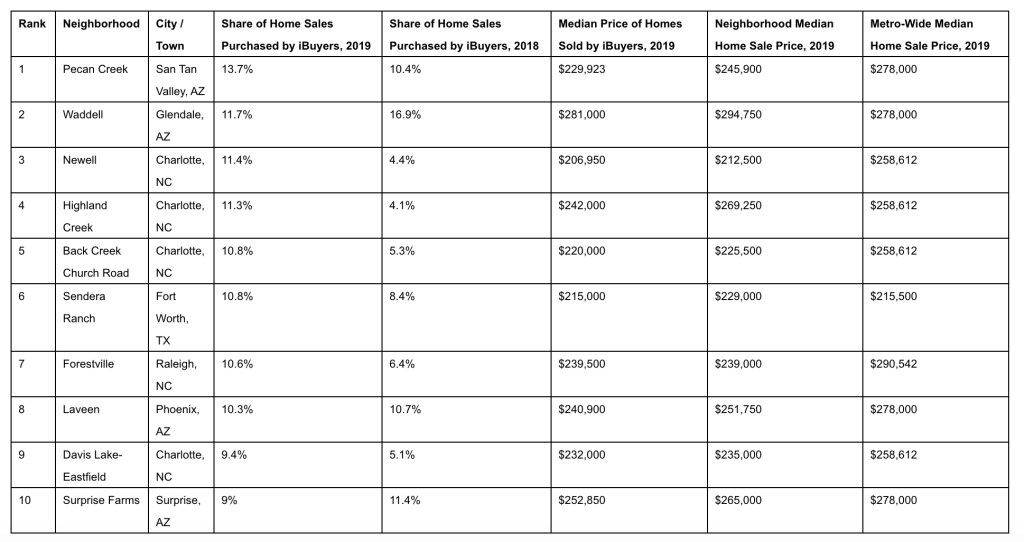

However, there are several neighborhoods in the U.S. in which iBuyers (companies that buy houses directly from sellers, make repairs, then sell the houses back into the market) where 10% or more of home sales from January through October.

The information comes courtesy of Redfin, which is an iBuyer itself.

According to Redfin’s analysis of the market, four Phoenix neighborhoods made the list of the areas where iBuyers bought the most homes. Phoenix is seemingly ground zero for many iBuyer expansions.

At the top of the list sits the Phoenix neighborhood of Pecan Creek, where iBuyers purchased 13.7% of homes. Last year, iBuyers bought 10.4% of homes in that neighborhood.

“A lot of what’s driving home sellers to accept offers from iBuyers in the Phoenix area is the ability it gives them to move up to another home quickly,” said Phoenix Redfin agent Kelly Khalil.

“A move-up buyer who wants to make a strong offer on a mid-range home in the $300,000 to $350,000 range can sell their entry-level house quickly to an iBuyer,” Khalil added. “Then they don’t have to make an offer with contingencies. We’re seeing this in a lot in affordable areas like San Tan Valley that are a little farther away from Phoenix proper.”

Lower down on the list was Surprise Farms in Surprise, Arizona. There, 9% of homes purchased were by iBuyers, actually down from last year’s total of 11.4%.

In the third quarter, the city of Knightdale, North Carolina, a suburb of Raleigh, saw the most share of iBuyers.

According to Redfin’s report, iBuyers bought 14.8% of the homes in that neighborhood in the third quarter. That’s up significantly from Q3 last year, when only 6.1% of homes purchased were by iBuyers.

Click on the image below to see the full list of the 10 neighborhoods where iBuyers bought the most homes so far this year.

“The fact that iBuyers have reached over 10% market share in some places could be an indication of how big iBuying could get nationwide once the business model is perfected,” said Redfin chief economist Daryl Fairweather. “As iBuyers begin to expand in more expensive markets beyond the small foothold they currently have, we’ll get a clearer picture of whether they are capable of reaching a high level of market share nationwide.”