Haus Chief Economist and SVP of Analytics

This is the first installment of our economist Q&A series of the top housing market forecasts for 2021. Every Tuesday in December in the HW+ Slack channel, HousingWire will be hosting a Q&A with a different economist to dig into their predictions for the upcoming year.

To kick off the series, HousingWire Interviewed Haus Chief Economist and Senior Vice President of Analytics Ralph McLaughlin on his predictions for the year ahead. This article has been lightly edited for length and clarity.

HW: How will 2021’s political environment impact the housing market in the year ahead?

Ralph McLaughlin: Great question. I’m of the belief that the political environment will be even more important than it normally is. Plainly, we’ve experienced an unprecedented public health and economic crisis. Our initial efforts helped prevent catastrophe, but it appears we’ll need renewed protections for the millions of Americans still impacted by the pandemic in order to limit further damage. But definitely some promising news out of the Senate this morning! (Note I wrote my piece over a week ago).

HW: Can you go into that a little more? I know in your piece you mentioned the impact of a split Congress on the housing industry. What policy options are out there right now that we should keep a close eye on?

Ralph McLaughlin: I don’t necessarily think we need to create new policies as much as we need to renew our existing ones. Supplementary UI expired last July, and renewing this ASAP would be a big boon to both distressed renters and owners (but especially the former). Also, renewing forbearance programs that are set to expire this spring would also help, and we should keep an eye on that as well, but I do think we need to modify that program to require distressed homeowners to provide proof of economic or personal injury due to the pandemic.

Same with eviction moratoria for renters. This will provide help to those who need it while also minimizing the impact to note holders and landlords.

HW: Those existing policies have really shaped this year, so now, with 2021 only a month away, why might 2021 reveal the true economic damage the pandemic has brought to the housing market? How soon into the year might we start seeing that?

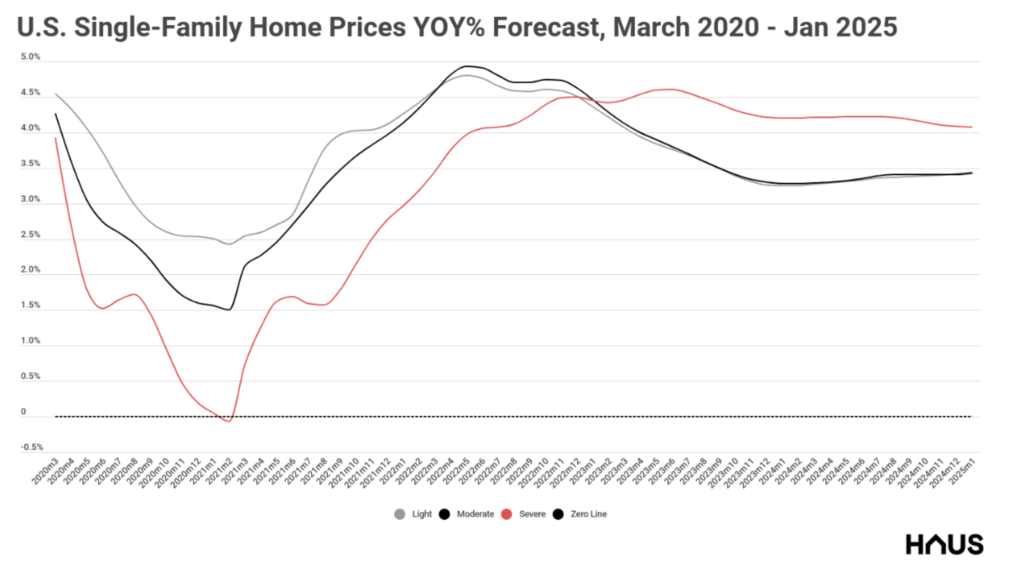

Ralph McLaughlin: Just to reiterate, our forecasts assume NO renewed protections for homeowners. Come spring 2021, when forbearance programs end, it’s possible some of those households won’t be able to pay their mortgage. If this is the case, we’ll either see an increase in foreclosure proceedings or a sharp rise in inventory as these households sell their home voluntarily.

Furthermore, on the rental side, we could see vacancy rates rise if eviction protections or extra UI isn’t renewed. This would also put landlords in even more distress and lower multifamily valuations. If the sharp rise in inventory arrives just as the economy starts to recover, we could see both rising inventory and rising mortgage rates, which wouldn’t be great for home price appreciation or sales volumes in the short run.

HW: In your article, you mention five indicators. Of those five, which are you following the closest or are most interested in and why?

Ralph McLaughlin: I’ve always been a sucker for home price growth since it represents the ultimate interaction of both supply and demand. But in the housing market, home prices tend to be lagging indicators, so I often look at home sales and housing permits, both of which can tell you what consumers are feeling as well as suppliers.

Also important, but not in our forecasts, is inventory. We often defer to thinking about demand in the housing market, but as we’ve seen on both the new and existing home sales side, it’s also very important to look at supply.

HW: In your forecast, what are the biggest factors that could disrupt your predictions for 2021?

Ralph McLaughlin: Namely, if we get cross-aisle cooperation in the Congress, the sky’s the limit with respect to how we can help the economy recover and also how we can help the 2021 housing market be the sail it normally is for the economy as it comes out of a recession.

Much of our forecasts of falling home price growth and home sales are likely to be too pessimistic if we pass a new stimulus package ASAP that includes renewed protections for those hurt most by the pandemic. In fact, our initial home price forecast back in April looks more like what we could see if we get a package passed.

HW: Speaking of the impact that COVID will have on the housing market, do you think we’ll see a surge of foreclosures next year? Why or why not?

Ralph McLaughlin: Given how much home prices have surged over the past four months, I actually think it’s unlikely we’ll see a large pickup in foreclosures. Unlike the great recession, impacted homeowners today likely will see their home go up in value rather than down, so there’s less incentive to walk away.

That said, there would be incentive to sell and realize that appreciation which could lead to a rise in “shadow” distress: inventory where homeowners need to sell because they’ve been hit hard and wanting capture that new equity rather than foreclose. On top of that, it’s also possible the backlog of pre-pandemic foreclosures hits the markets at the same time when they can resume on Jan 1. Quickly rising inventory – for whatever reason – could shift the spring 2021 season towards a buyers market.

HW: Let’s talk about that. From your perspective, will we see a seller’s or a buyer’s market in 2021?

Ralph McLaughlin: Certainly, geography matters and some places will see a buyer’s market while others will be a seller’s market. I suspect pricy West Coast markets and markets dependent on tourism will struggle this spring, but are likely to come back once a vaccine becomes widely available.

I also am keeping an eye out on zoom towns and less dense, more affordable locales where we’ve anecdotally since rising demand over the past six months. So in short, I suspect a buyer’s market in many areas out West but a seller’s market in the South and Midwest. Nationally, I think we might see a slight swing towards a buyer’s market but sellers will continue to have power unless inventory takes a big swing up.

HW: What is your overall call for 2021? Optimistic year for housing or turbulent waters ahead?

Ralph McLaughlin: Without renewed protections, it’s going to be turbulent. If we get a decent package, things look pretty good since we have a large demographic tailwind helping the U.S. housing market over the next 5-10 years. I have optimism now it’s looking like we’ll get a package, so my outlook has turned a bit rosier over the past week!

HW: Do you have any other closing thoughts?

Ralph McLaughlin: The one area I am concerned about is commercial multifamily, since a much larger share of those loans are private/community bank held and as such landlords haven’t received as much protections when having to pay their mortgage (especially with widespread eviction moratoria). But beyond 2021, the future for both owner-occupier and rental market looks awesome with strong forecasts for household growth!

The next 2021 forecast Q&A features Mortgage Bankers Association Chief Economist Mike Fratantoni. You can read his full forecast now by going here. Fratantoni will discuss his forecast in the HW+ Slack Channel this Tuesday Dec. 8 at 11 CT. If you’re an HW+ member and not yet a part of the Slack channel and would like to join, email HW+ Managing Editor Brena Nath at [email protected].