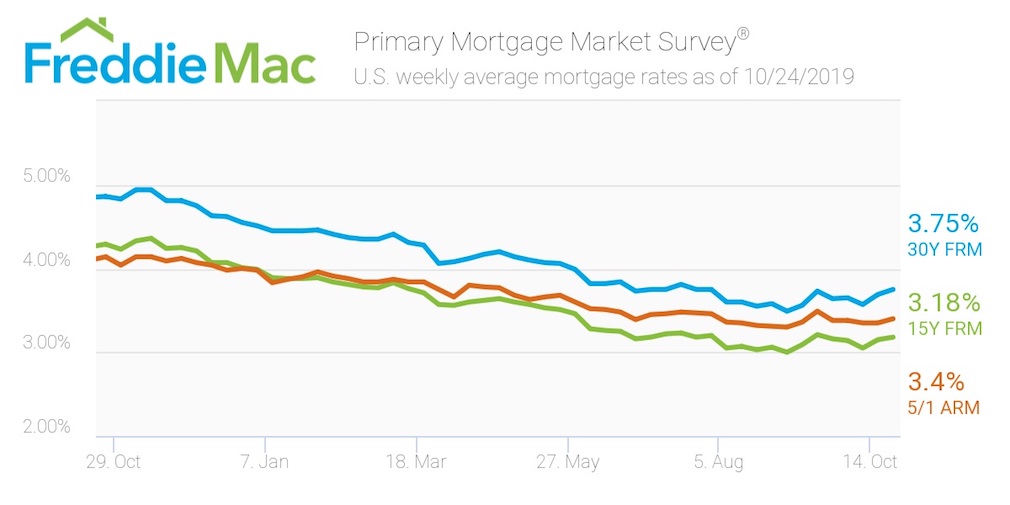

This week, the average U.S. fixed rate for a 30-year mortgage rose to 3.75%. That’s 6 basis points above last week’s 3.69% but still more than a percentage point below the 4.86% of the year-earlier week, according to the Freddie Mac Primary Mortgage Market Survey.

The U.S.-China trade war is triggering interest rate volatility, said Sam Khater, Freddie Mac’s chief economist. Even with the uptick, demand from would-be borrowers remains high, he said.

“The outlook for a favorable resolution to the trade dispute between the U.S. and China is still unclear, introducing some volatility into financial markets and the benchmark 10- year Treasury yield,” said Sam Khater, Freddie Mac’s chief economist. “Mortgage rates are following suit at near historic lows, while mortgage applications to purchase a home remain higher year over year.”

The 15-year FRM averaged 3.18% this week, inching forward from last week’s 3.15%. This time last year, the 15-year FRM came in at 4.29%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.4%, increasing from last week’s rate. of 3.15% Nevertheless, the percentage is still below 2018’s rate of 4.14%.

The image below highlights this week’s changes: