As the prices of new homes are rising, so is the respective home equity of the people who own those homes.

That’s a trend that’s been going on for more than eight years.

In fact, a new report from CoreLogic states that equity in real estate is now at an all-time high. Since the second quarter of 2018, the average borrower in the U.S. gained about $5,000 in home equity.

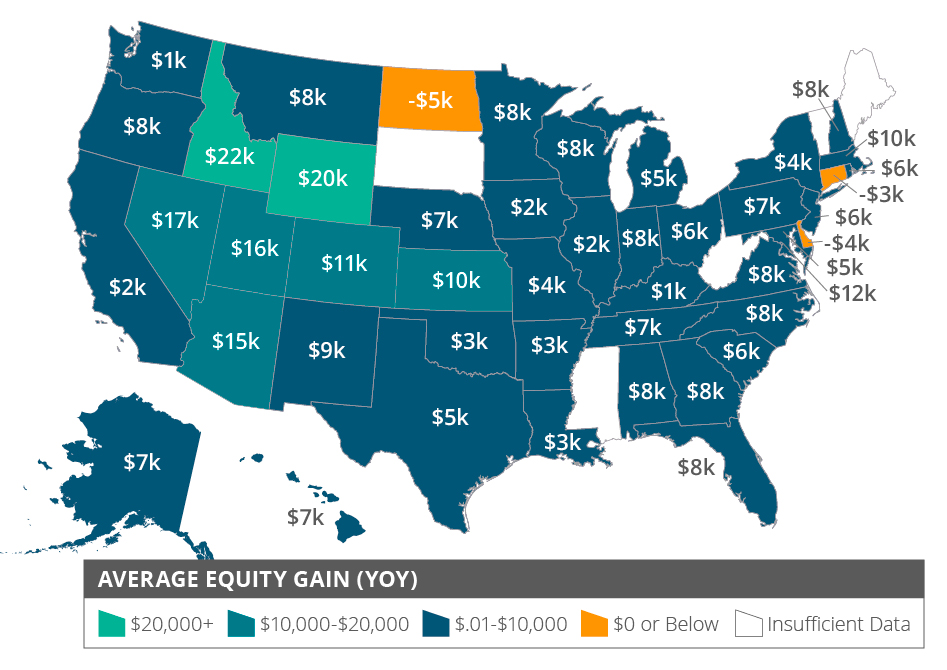

The strongest home equity growth in the last year has been in the western states, according to CoreLogic’s Home Equity Insights report.

The report said that homeowners in Idaho gained an average of $22,000 per borrower in the last year. Wyoming homeowners saw a $20,000 gain and homeowners in Nevada saw a $17,000 increase in equity in the last year.

Conversely, New York saw only a $4,000 gain in equity, while Illinois saw a small $2,000 gain.

Connecticut, Delaware, and North Dakota actually saw borrower equity retreat, with Connecticut and Delaware seeing declines in home prices.

Overall, home equity has risen in 47 states and the District of Columbia, CoreLogic says.

“Borrower equity rose to an all-time high in the first half of 2019 and has more than doubled since the housing recovery started,” CoreLogic Chief Economist Frank Nothaft said. “Combined with low mortgage rates, this rise in home equity supports spending on home improvements and may help improve balance sheets of households who could take out home equity loans to consolidate their debt.”

By the end of 2018, homeowners had gained almost $10,000 in equity in a years time, CoreLogic said.

Home equity will also continue to grow, the CoreLogic Home Price Index forecast predicts.

Homeowners with a mortgage – about 63% of all homeowners – saw equity increase by 4.8% since the second quarter of 2018, a total of nearly $428 billion. The average homeowner gained about $4,900 in equity over the last quarter, Q1.