Renting an apartment hasn't been this popular in nearly 20 years, as the rate at which people are renting apartments hasn't been this high since 2000.

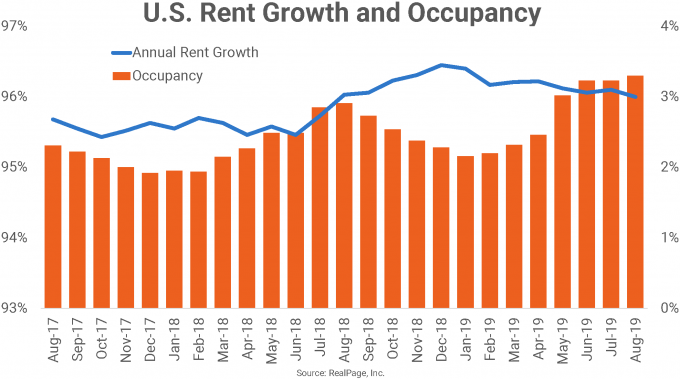

According to new data from RealPage, apartment occupancy was the highest in August that it has been at any point since the tech boom in 2000. August also marked the seventh consecutive month that apartment occupancy has risen.

The 150 largest apartment markets in the country averaged an occupancy of 96.3% in the month of August. In July, it was 96.2%.

All four regions of the country saw a rise in its occupancy, with 97.1% occupancy in the Northeast; 96.6% in the West; 96.5% in the Midwest and 95.7% in the South.

Of the 50 largest markets in the U.S., eight of them saw a weaker occupancy rate in August than in July, while only three saw occupancy below 95%. Conversely, nine saw greater than 97% occupancy in August.

(Image courtesy of RealPage. Click to enlarge.)

Beyond that, RealPage's report also showed that August was the 12th consecutive month that annual rent growth was at or above 3%, which hasn’t happened since 2016.

Rent growth continues to steadily rise at 3% around the nation, but both rent growth and occupancy overall rose slightly from July to August.

Across the U.S., monthly rents averaged $1,418 in August. This is also up slightly from July’s average monthly rent of $1,414.

The top market for annual rent growth in August was Phoenix-Mesa-Scottsdale, AZ, with 8.2% rent growth. Although these Arizona metros had the highest percentage of rent growth, St. Louis, Missouri saw the quickest acceleration in rent growth in August, seeing it's own 18-year high, RealPage said.

There were 33 major markets that saw annual rent growth rise from its levels in 2018. However, Florida and California saw slowing rent growth.