Home prices rose 1% in the second quarter from a year earlier, marking the 32nd consecutive quarter of increases, the Federal Housing Finance Agency said in a report.

“House prices rose again in all states and the top 100 metro areas, but the pace of growth has slackened,” FHFA Supervisory Economist William Doerner. “The majority of states and cities are experiencing slower house price gains than they did a year ago, even with constrained housing supply and extremely attractive mortgage rates.

Nationally, home prices in all 50 states and Washington, D.C. increased since the second quarter of last year.

The states with the largest gains were Idaho at 11.4%, Utah at 7.7%, Tennessee at 7.2%, and Georgia and Arizona both at 6.9%.

The states that showed the least amount of annual appreciation are Delaware at 1.2%, Maryland at 1.5%, District of Columbia at 1.8%, Iowa at 2.2% and New jersey at 2.7%.

According to FHFA, home prices rose in all of the 100 largest metropolitan areas in the U.S. over the last four quarters.

Annual price increases were the largest in Boise City Idaho, where prices ticked up 13.6%. However, prices were weakest in Oxnard-Thousand Oaks-Ventura, California, where they only increased 0.5%.

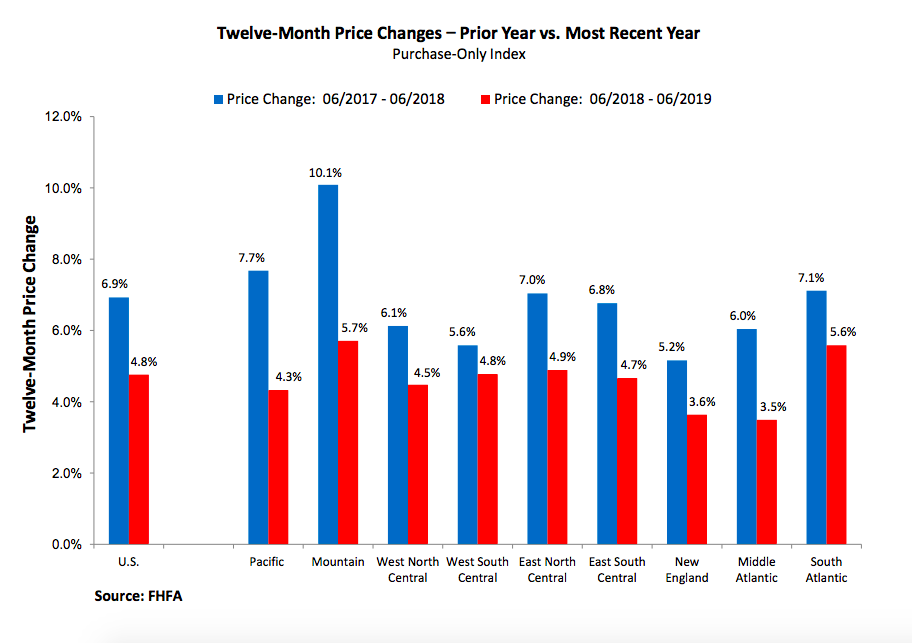

The report also explains across the nine census divisions, the Mountain division once again saw the strongest appreciation growth, rising 6.6% annually and increasing 1.3% in the second quarter of 2019.

Notably, annual house price appreciation was the weakest in the Middle Atlantic division, where house prices rose by only 4% year over year.

The chart below compares 12-month price changes to the prior year: