Home prices are appreciating, and home sellers are realizing a sizable return on their investment as a result.

Those who sold their homes in the first quarter of 2019 made a 31.5% return, pocketing an average gain of $57,500, according to the latest from ATTOM Data Solutions.

While home seller gains are down from Q4 2018’s $60,000, they are still up year over year, when price gains averaged $56,733, ATTOM noted.

According to the report, these were the areas with the highest home seller returns:

San Jose, California: 84.1%

San Francisco, California: 70.9%

Seattle, Washington: 63.1%

Modesto, California: 59.7%

Salt Lake City, Utah: 56.5%

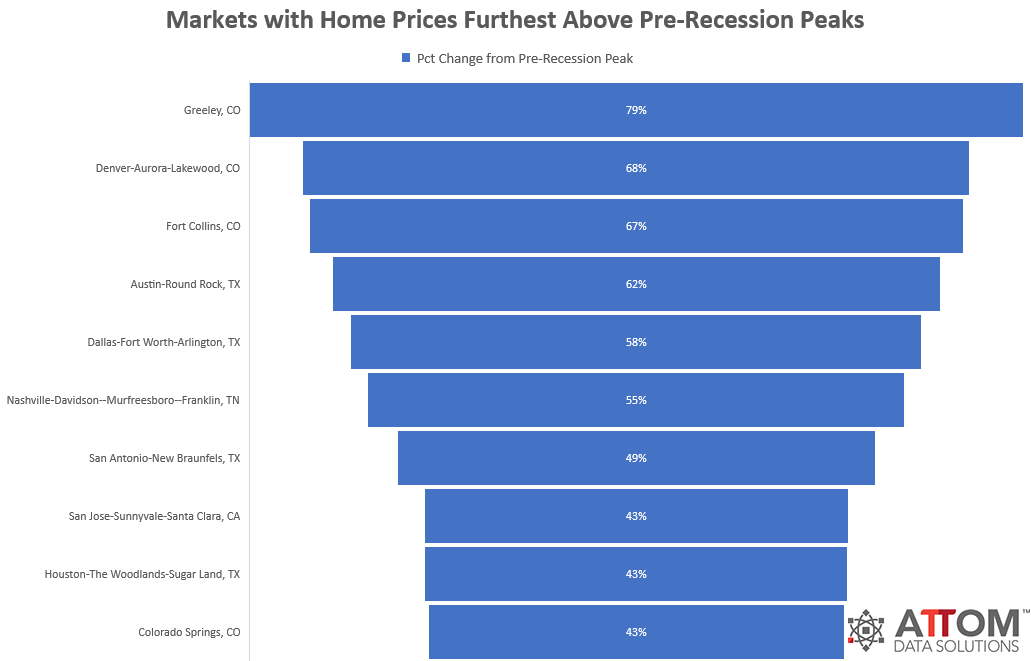

Also, 59% of the 129 metros analyzed in the report saw median home prices rise above pre-recession peaks, with the top five highest prices reported in Colorado and Texas (click to enlarge the chart to the left).

Also, 59% of the 129 metros analyzed in the report saw median home prices rise above pre-recession peaks, with the top five highest prices reported in Colorado and Texas (click to enlarge the chart to the left).

ATTOM’s data revealed that all-cash home sales comprised 28% of all single-family and condo sales in Q1, up slightly from 27.7% in the previous quarter but down from the 28.9% observed one year ago.

Meanwhile, the share of sales made by institutional investors was down across the country, falling to 1.8% in Q1 from the previous quarter’s 3.7%.

The areas with the highest share of institutional investor sales in Q1 were Columbia, South Carolina; Atlanta, Georgia; Charlotte, North Carolina; Memphis, Tennessee; and Las Vegas, Nevada.

“We are starting to see homes sales prices and profit margins softening for the nation,” said Todd Teta, ATTOM’s chief product officer. “However, home prices are still above pre-recession peaks in 59 percent of local markets, and as the buying season starts to kick into gear, the next few months may provide even more answers to the question of whether a lasso is indeed around the market or if the recent trend is a temporary bump in the ride.”