Several reports indicate that Millennials are predicted to dominate the housing market in 2019.

As many of these young adults enter the market as first-time buyers, some will experience difficulty navigating affordability and inventory concerns.

“We believe Millennials are the driving force in household formation, finally rotating toward homeownership and away from renting,” Wells Fargo Securities Head of RMBS Research Vipul Jain said in a statement. “In our view, the lack of supply to meet this demand will remain a key driver for the housing market in 2019 and should provide support for home prices.”

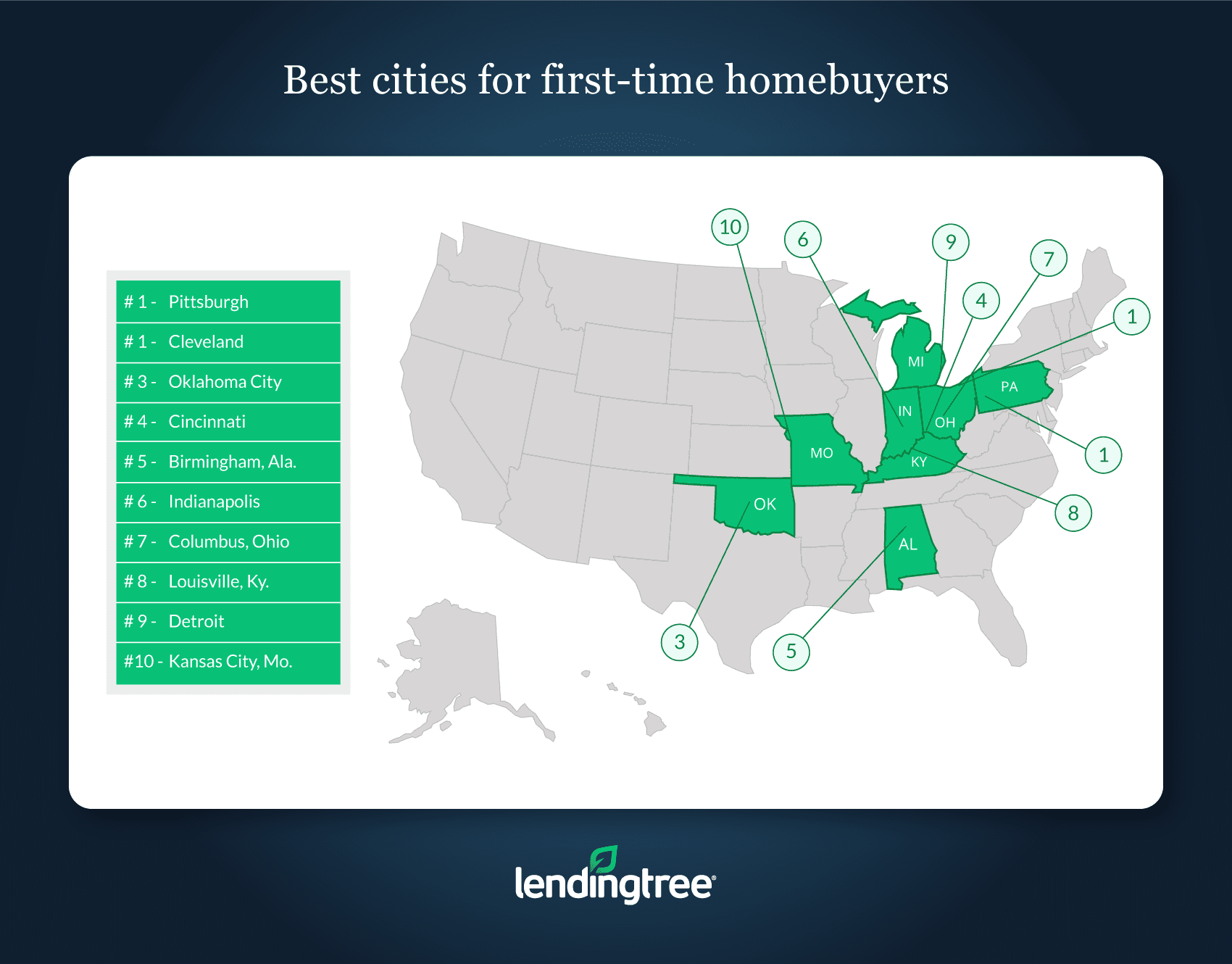

Luckily, LendingTree recently released a report revealing the best U.S. cities for first-time homebuyers.

According to the company's data, the top metros offer first-time homebuyers low down payment percentages and allow them to save big on FHA mortgages.

LendingTree discovered that Pittsburgh was the No. 1 metro in the country for first-time buyers, with the average down payment amounting to $34,049.

The company calculated this ranking by comparing the metros average credit score and down payment percentage, deeming it the easiest city for first-time buyers to purchase a home.

“Down payments are usually a major hurdle for first-time homebuyers to overcome, as many struggle to come up with the amount of cash necessary to make a down payment,” LendingTree writes. “The lower the down payment is, the easier it is to afford a home.”

Notably, Cleveland and Oklahoma City followed closely behind with down payments amounting to $34,049 and $32,775, respectively.

Not surprisingly, several Californian metros were listed amongst the most difficult metros for first-time buyers to purchase homes. In fact, Los Angeles was named the toughest metro, with a down payment totaling $95,418. Residents living in Denver and San Francisco were also challenged, with down payments reaching $74,317 and $128,627, respectively.

The image below shows which metros are the best for first-time buyers:

(Click to enlarge)

(Source: LendingTree)

NOTE: LendingTree scored cities based on factors including average down payment, average credit score, average FHA down payment and more.