A new report by the AARP Public Policy Institute has found that Americans aged 50 and older are increasing finding housing to be less affordable as result of impacts of the recession.

In the summary, "Housing for Older Adults: The Impacts of the Recession," the report found an increase in the percentage of older Americans face a "housing costs burden," defined as those who pay more than 30% of their income on housing expense. For those with incomes below $23,000 per year, 96% face an unsustainable level of housing costs. The percentage drops to 67% for those with incomes up to $47,000.

The report also found that the percentage of households aged 50 and older who owned their home without a mortgage dropped from 40% in 2000 to 36% in 2009. The number who own a home with a mortgage increased by the same 4 percentage from 38% to 42%, while the percentage of those renting their homes remained static at 20%.

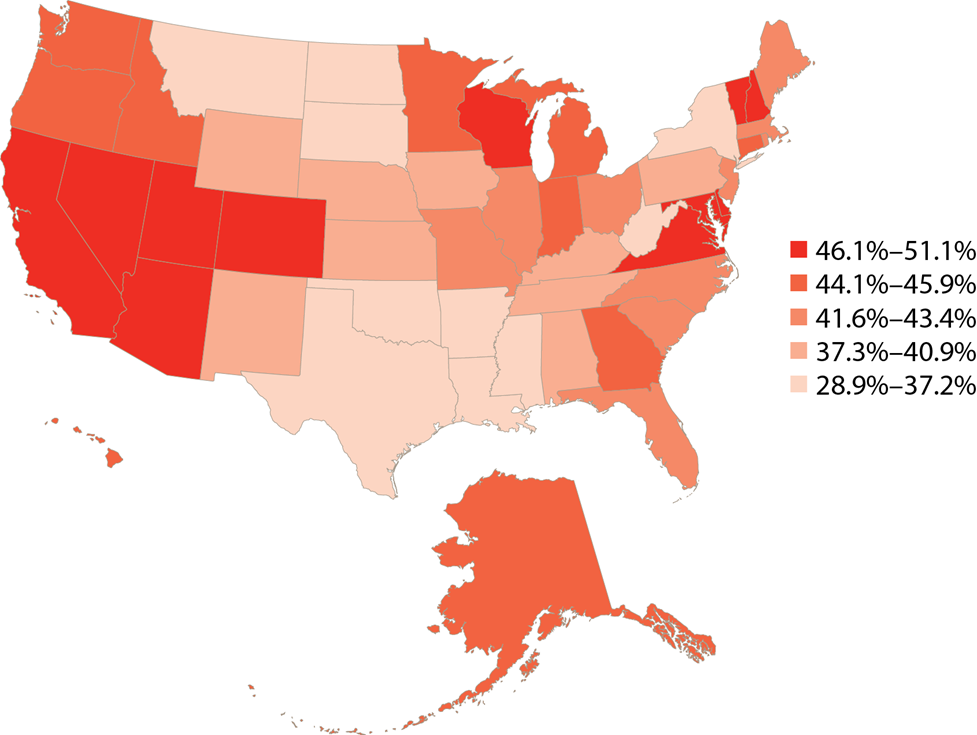

Western states had the highest incidence of housing cost burden. The above map of the U.S. shows the percentage of homes facing financial risk due to housing costs by state.

The report also found that the result of the mortgage crisis and decreased in home values has led to a significant decrease in the amount of home equity that many older homeowners had been counting on. The result has been a loss of flexibility and stability for homeowners who viewed their equity as a safety net.

Pointing to the changing dynamics for older homeowners, the report suggests that more needs to be done to help address these housing affordability concerns, including policies that seek to expand the stock of affordable options that meet the needs of seniors.