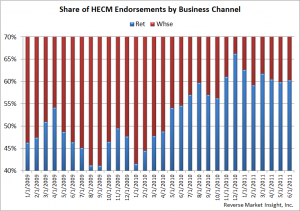

After the regulatory changes related to FHA lender approval and loan originator compensation have settled into mortgage production, the distribution of endorsements by business channel have appeared to end a period of volatility and eased into a consistent range.

According to the latest Wholesale Leaders Report from Reverse Market Insight (RMI), the distribution of retail and wholesale loan production has fallen into a new standard of 60% retail and 40% wholesale.

Average Retail volume has grown over the previous two years from an average of 47% in 2009 to an average of 54% in 2010 to the 60% in the current year. The range of distribution saw the most volatility in 2010 with retail market share being spread from 42% to 66%. Volume in 2009 fell within a less volatile range of 41% to 50%. This year is falling into a much tighter range of 59% to 63%.

Both channels are falling into similar movements for growth, moving in positive direction in June, following two months of declines. Total endorsement growth for the month was 13%, fueled by 12.8% growth in retail and 11.7% growth in wholesale. Prior to the current three months of similar trends, the movements between the two channels had been more disparate over the past year.

The Wholesale Leaders Report for June is the last month of this particular report. Next month, RMI is revising their reporting structure. This report will become the "HECM Originators Report" and will focus on the rankings of all companies originating HECM loans, regardless of FHA approval status.