Signaling the start of what is likely to be a challenging second half of the year for HECM endorsement volume, total endorsements dropped by 5.9% in July.

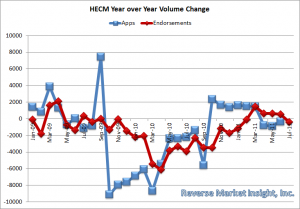

According to the latest Retail Leaders Report from Reverse Market Insight, endorsements in July totaled 5,511. After crossing over to year-over-year positive growth in March, the latest month fell back into negative territory at 6.6% below July of 2010.

With the start of this decline, expected to continue as the wind down of Wells Fargo is felt in the tail end of the year, it appears that the industry will see its third consecutive year of total HECM endorsement volume decreases. In July, Wells Fargo actually saw a boost to 1,719 likely related to their final push of origination pipeline before the clearing out is completed.

The second half of the year will also represent an interesting reshaping of the top 10 as lenders regroup and try to seize on voids left by the larger banks. MetLife, whose planned sale of their banking division and new licensing approach will likely impact their reach. Volume for MetLife fell in July by 30% to 716 units in July.

Additionally, application declines compared to the previous year support a continued downward trend as the industry struggles to make up for the falling volume from large footprints.