In the latest release of their U.S. Housing and Mortgage Trends report, CoreLogic stated that home sales in 2010 declined to the lowest level since the collapse in the housing market and that home sales reports from the National Association of Realtors (NAR) are overstated by about 15% to 20%.

The report pointed to price declines driven by a large imbalance between supply and demand and an increase in distressed sales. Although, non-distressed sales saw an increase in prices of 7% (primarily fueled by purchase incentives), there continues to be downward pressure on prices as a result of a higher share of distressed sales and their corresponding discount. Distressed sales' discount relative to non-distressed sales increased in 2010 to 37% from 30% in 2009. If these current trends continue, CoreLogic estimates that home prices could see a further 10% year-over-year decline by this Spring.

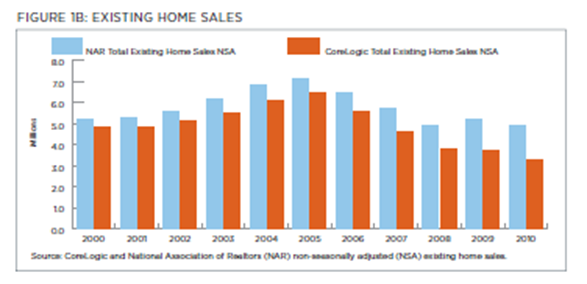

According to the report, data from NAR began to become elevated in 2006 relative to other sales related data from CoreLogic, MBA, HMDA and the Census. Estimates for 2010 mark the widest divergence between the reports leading to CoreLogic's estimate that NAR's data is inflated by 15% to 20%. The chart below demonstrates the difference between CoreLogic and NAR sales data from 2000 to 2010.

CoreLogic attributes the divergence to several reasons, including benchmarking drift, more sales going through MLS systems due to consolidation and a lower share of for sale by owners. They also indicated that NAR's elevated sales data indicates that their months' supply data are accordingly too low. NAR's data suggested an 8.1 month supply as compared to CoreLogic's reporting of 16 months.

In 2010, CoreLogic estimates that home sales totaled 3.6 million, which is a 12% decrease from the estimated 4.1 million sales in 2009. NAR, on the other hand, reported that that home sales only fell 5% from much larger estimates of 4.9 million sales in 2010, down from 5.2 million sales in 2009.

Previous reporting from the Reverse Review sought to examine the variance in home sale and price data from NAR and other sources. This report from CoreLogic has been the most direct indication that the NAR data may be inflated.