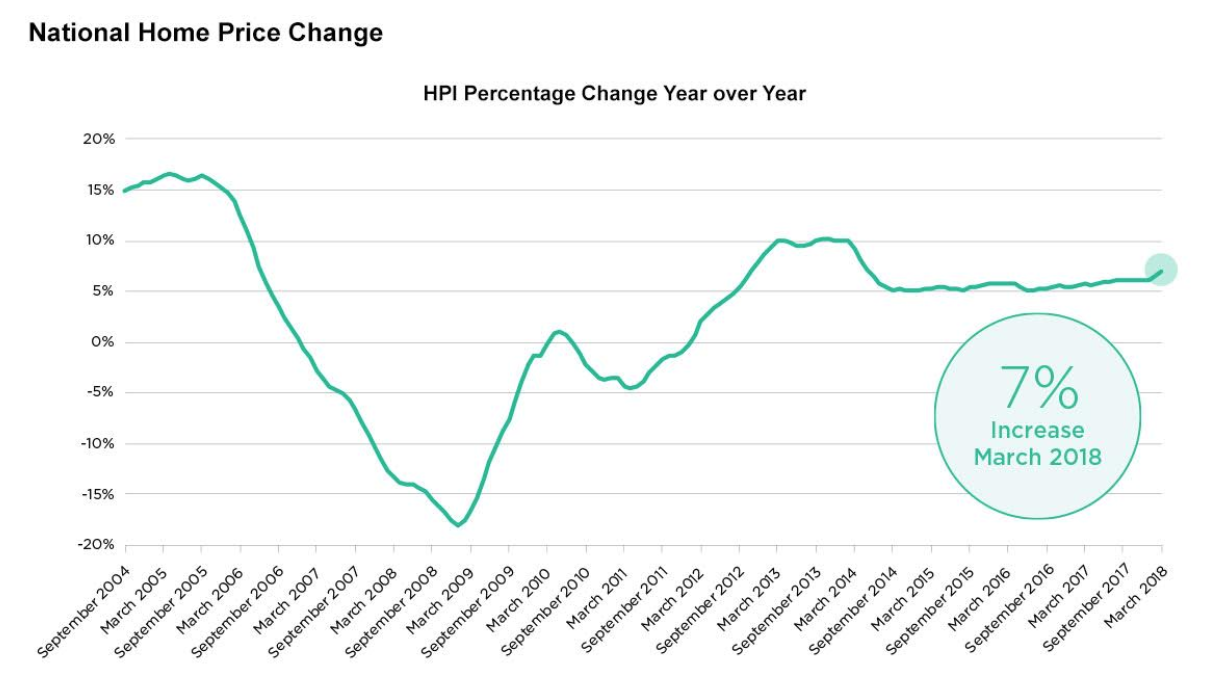

Home prices showed yet another surge in March, causing worry over rising affordability issues, according to the latest Home Price Index report from CoreLogic, a global property information, analytics and data-enabled solutions provider.

Home prices increased 7% nationally from March 2017 to March 2018, and increased 1.4% from the prior month, according to the report.

The chart below shows home prices have been steadily increasing at the same rate for the past several years.

Click to Enlarge

(Source: CoreLogic)

“High demand and limited supply have pushed home prices above where they were in early 2006,” CoreLogic Chief Economist Frank Nothaft said. "New construction still lags historically normal levels, keeping upward pressure on prices.”

An analysis of housing values in the country’s 100 largest metropolitan areas based on housing stock, indicates 37% of metropolitan areas have an overvalued housing market as of March 2018, CoreLogic reported.

Another 28% of the top 100 metropolitan areas were undervalued while 35% were at value. When looking at only the top 50 markets, 50% were overvalued, 14% were undervalued and 36% were at-value.

The national home-price index is projected to increase by 5.2% from March 2018 to March 2019, according to the CoreLogic HPI Forecast.

The forecast is an econometric model that projects calculations from analyzing state level forecast, which are measured by the number of owner-occupied households for each state.

“The dream of homeownership continues to fade away for the average prospective buyer,” CoreLogic CEO Frank Martell said. “According to the report this can be attributed, to the top five markets in the country being overvalued because home prices are rising faster than incomes.”

If this trend continues, homeownership for typical buyers attempting to find a home will be difficult.

“Lower-priced homes are appreciating much faster than higher-priced properties, making the affordability crisis progressively worse,” Martell said. “This is clearly an unsustainable condition that can only be remedied by aggressive and coordinated public/private sector actions.”