The latest Case-Shiller report showed home prices are continuing to rise, but now experts say not only are those high prices here to stay, but homebuyers could be pummeled this spring by an increase in competition.

One expert explained that homebuyers will face not only the typical spring competition, but also the pent-up demand from would-be buyers looking for, but unable to find, a home over the past several months.

“The spring home shopping season will soon be in full swing, and with it we can expect the usual seasonal bump of would-be home buyers to come out of the woodwork to compete over a shrinking pool of homes to choose from,” Zillow Senior Economist Aaron Terrazas said. “But in a twist, this year’s buyers may be competing against some of those buyers who have been unsuccessful during the past few months.”

“Increasingly, the traditional seasonal boundaries around home shopping season – which generally heats up in early spring and cools off by late summer in time for back-to-school season – are becoming less pronounced,” Terrazas said. “Limited supply, fierce competition and rising prices are forcing many buyers to stay on the market longer in hopes of finding the right home at the right price. More inventory is really the only cure for those pressures right now, especially for those at the entry-level end of the market, but it has proven frustratingly slow in coming.”

And one expert explained this increased competition is also increasing home prices, which means high home prices are here to stay.

“Our first glimpse into Case-Shiller home price data in 2018 confirms high prices are here to stay,” realtor.com Chief Economist Danielle Hale said. “In fact, if we continue to see a steady stream of buyers and owners remain largely uninterested in selling, we can expect prices to continue to rise.”

Another expert explained that while homes on the lower end of the market are failing to keep up with demand and seeing quickly increasing prices, the same can’t be said for luxury homes.

“The Case-Shiller Home Price Index continues to support our view that today’s housing market is driven by a mismatch of demand and supply,” said Tian Liu, Genworth Mortgage Insurance chief economist. “There is robust demand by first-time homebuyers for affordable homes, and equally robust supply for higher-end homes.”

“Over the last 12 months, the low-tier homes measured by the Case-Shiller Index have out-performed the aggregate index significantly while the high-tier homes have under-performed,” Liu said.

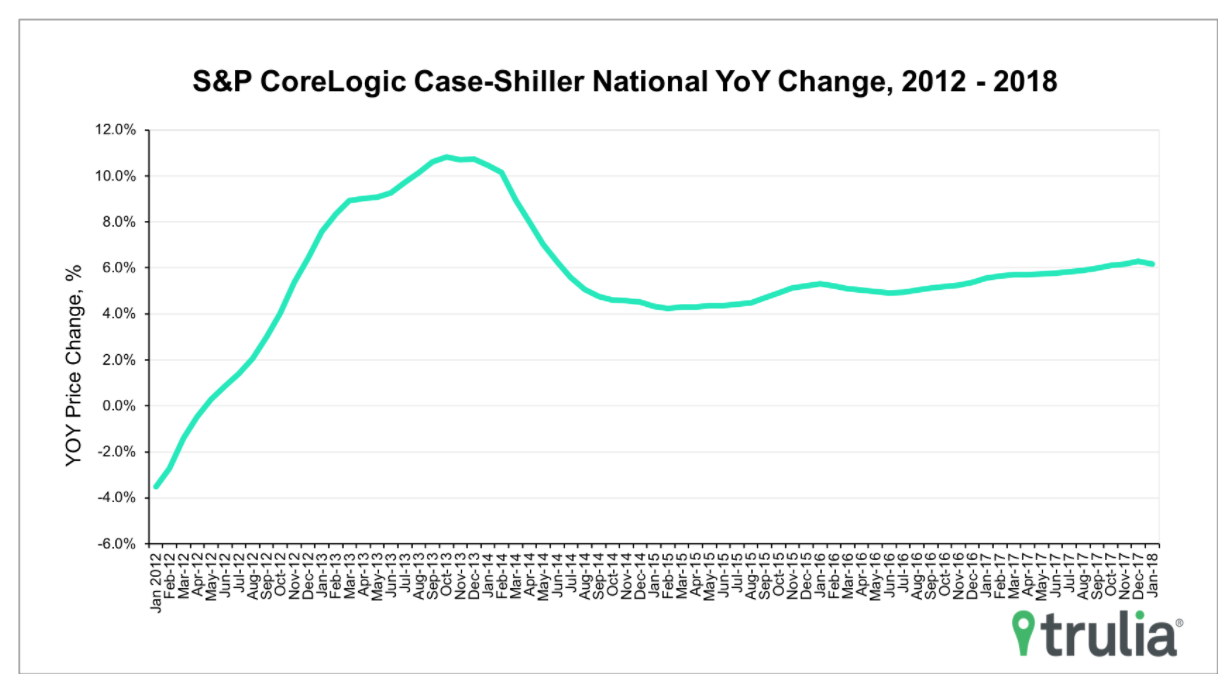

The chart below from Trulia shows the amount of home price increases has been steadily climbing since about mid-2014. In the past couple months, the increase rate surpassed 6%, and has held there.

Click to Enlarge

(Source: Trulia)

However, not all experts expect home price growth to continue at its current rate.

“That is the first time annual growth has fallen since June 2016, and supports our view that house price gains peaked at the end of last year,” Capital Economics Property Economist Matthew Pointon said. “We expect growth will continue to ease gradually this year, although tight market conditions and rising household incomes argue against a sharp slowdown.”