A steady flow of executive orders and presidential memoranda from President Donald Trump dominates media headlines. Trump even signed an executive order on Wednesday asking for the review of designations under the Antiquities Act.

But with or without Trump, the housing market must go on.

So as the world, once again, tuned in to Trump’s tax reform plans on Wednesday, HousingWire took a break and focused on what we know best: housing. And WITHOUT discussing potential political ramifications on the industry. We listened to reader feedback and decided to host a webinar free of politics. Enjoy the break.

Darius Bozorgi, Veros CEO, Mike Fratantoni, Mortgage Bankers Association chief economist, and Douglas Duncan, Fannie Mae chief economist, joined HousingWire on a webinar on Wednesday to discuss what’s next for the housing market and mortgage nation.

After all, housing inventory, home prices and mortgage interest rates are flooding HousingWire headlines, just as executive orders, tax reform and health care are flooding the national headlines.

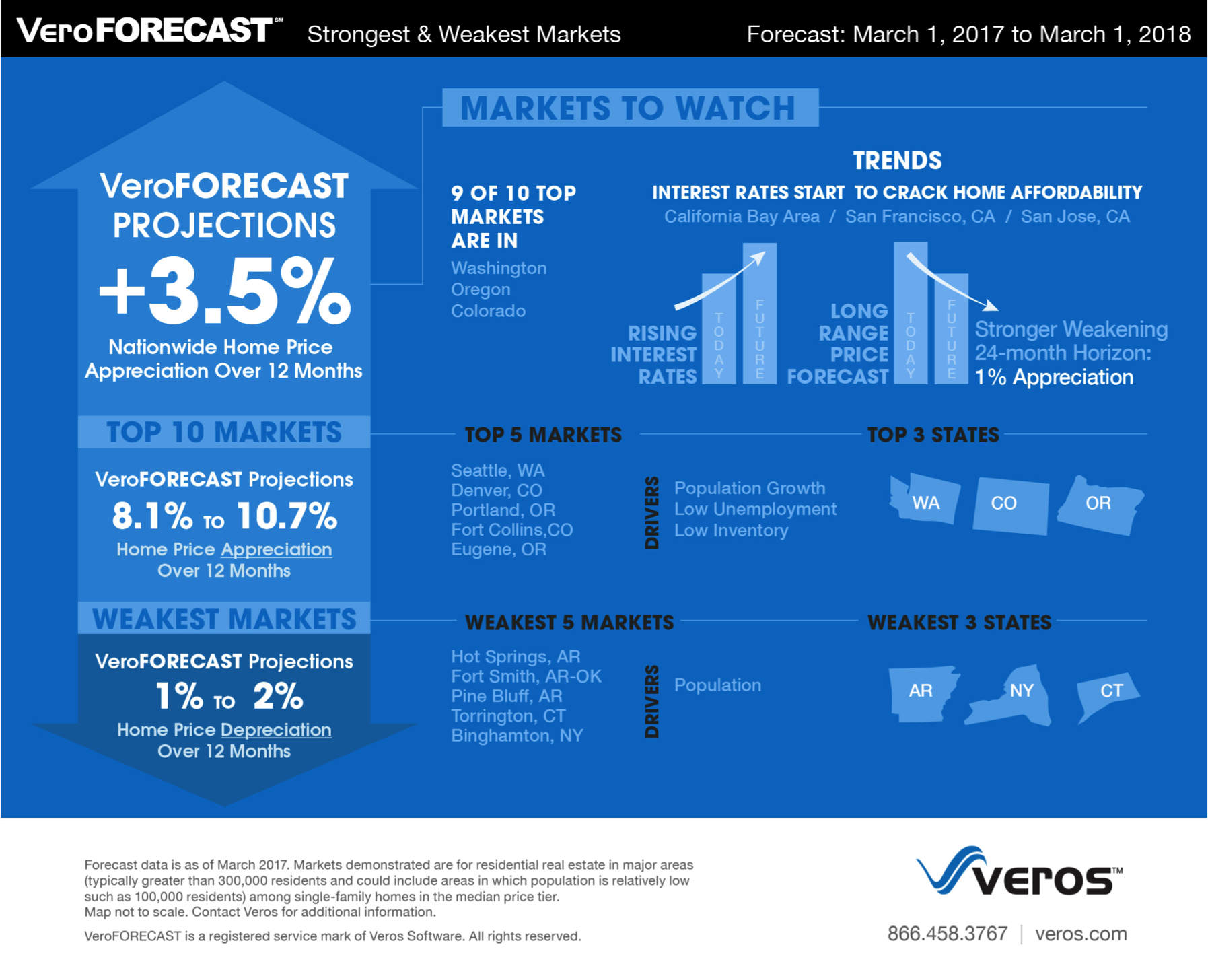

To kick things off, here is a forecast chart from Veros on the future of home prices, along with the strongest and weakest markets.

Click to enlarge

(Source: Veros)

Let’s start of with a question that keeps cropping up: Is America in a housing bubble?

Nay, said Bozorgi, and the others. “There is no housing bubble. There has been what we feel is a steady growth.”

Bozorgi explained that he is not seeing anything remotely close to what the industry saw post 2007 and 2008.

So America isn’t in a bubble but is it in a recession?

Duncan said they do expect in a few years to see recession-like conditions. However, he added that housing would perform relatively better in a recession.

Fratantoni added to Duncan’s point and stated, “we are already at recession levels in homebuilding.”

But as far as home prices, Fratantoni said that national home prices growing at triple the rate of the recession isn’t sustainable.

“I wouldn’t be shocked if we hit a flat period with minimal growth before we start growing again,” Fratantoni said on the future home prices.

Jacob Gaffney, HousingWire Editor-in-Chief, concluded the webinar, asking the panelists, “What is the biggest threat to the economy?”

Duncan said that there could be a recession if for some reason there was a sudden problem in the global mobility of oil.

Fratantoni noted that the Federal Reserve waiting too long to raise rates could also be a problem.

Bozorgi, although, doesn’t foresee a major shock to the housing market, reiterating Gaffney’s point that housing market progress really will be slow and steady.

These points are only a small portion of what the webinar covered. Need to know more? Check out the full webinar for free.