In 2013, Fannie Mae and Freddie Mac began shifting credit risk to investors as part of a plan to reduce the overall risk of the government-sponsored enterprises, and therefore, the risk to the American taxpayers.

In those last few years, Fannie and Freddie developed various forms of credit risk-sharing, including debt issuances, insurance/reinsurance transactions, senior‐subordinate securitizations, and other lender collateralized recourse transactions.

And a new report published Monday by the Federal Housing Finance Agency shows how much progress the GSEs are making in their collective effort to protect the taxpayers from risk.

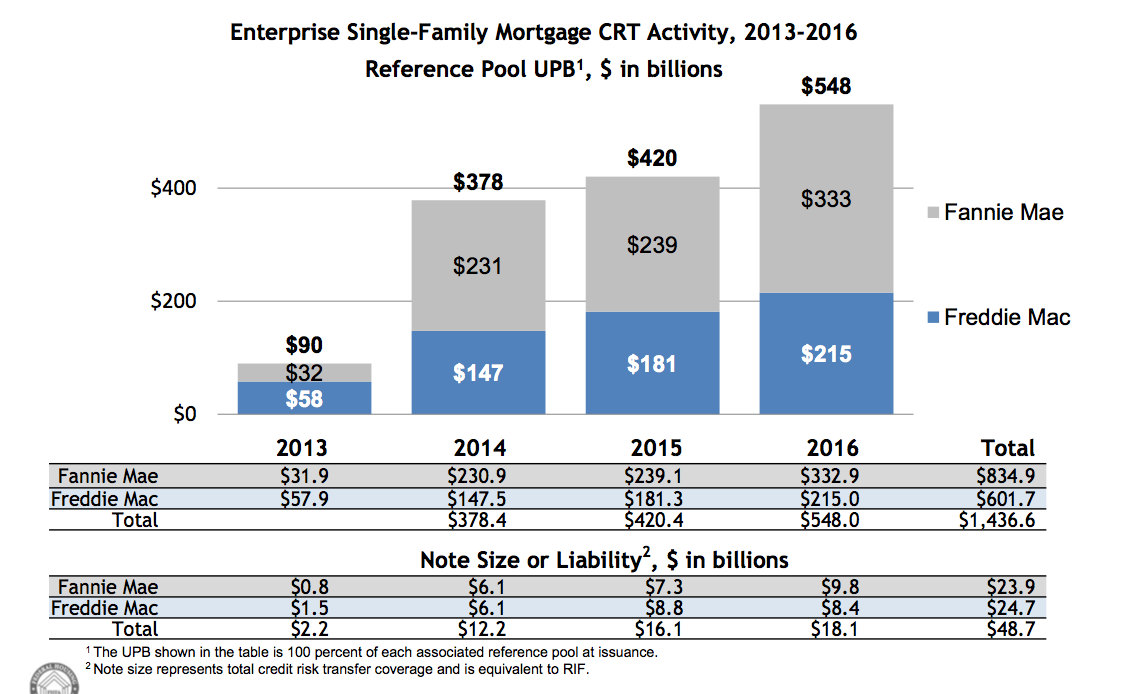

According to the FHFA report, in 2016, the GSEs transferred $18.1 billion of credit risk on mortgages with $548 billion in unpaid principal balance through capital markets, insurance, and pilot credit risk transfer transactions.

That’s an increase from 2015, when the GSEs transferred $16.1 billion of credit risk on mortgages with $420.4 billion in similar transactions.

Of the $18.1 billion of credit risk transferred in 2016, $9.8 billion came from Fannie Mae, while the remaining $8.4 billion came from Freddie Mac.

In total, the GSEs have now transferred nearly $49 billion of credit risk on $1.4 trillion in unpaid principal balance since the risk-sharing programs began, as seen in the graph below from the FHFA report.

(Click to enlarge)

“Fannie Mae and Freddie Mac have made credit risk transfer a regular part of their business and they continue to improve and expand the scope of their programs and explore different transaction structures,” said FHFA Director Mel Watt. “This report demonstrates the ongoing innovation, the progress being made, and our commitment to transparency as we continue to enhance these programs.”

The FHFA report also noted that Freddie Mac began selling a portion of the first dollar of expected credit losses in 2015 and did so again in 2016.

The report also adds that Fannie Mae began selling a portion of the first dollar of expected credit losses in 2016.

The FHFA said in the report that both GSEs will continue to explore these and other options for risk-sharing.

“Feedback obtained by selling a portion of the initial losses, both from credit risk investors and from pricing of so-called first-loss bonds, has provided important information to FHFA and the Enterprises,” the FHFA report states. “As the Enterprises’ credit risk transfer programs continue to evolve, FHFA and the Enterprises will take that information into account in considering the structure of future credit risk transfer transactions.”

Click here to see the full FHFA report.