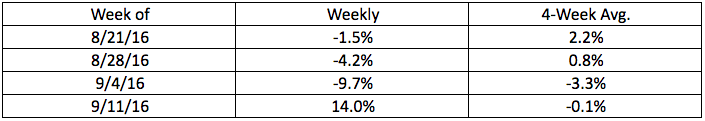

Appraisal volume managed to stay afloat during the Labor Day holiday, which typically impacts volume due to the shortened week, and now, looking at the latest report from a la mode, it more than bounced back the week after.

The previous report found that the Labor Day holiday impacted volume significantly less than the average 13.1% decline, only falling 9.7% for the week.

And according to the newest report, volume surged 14% for the week of Sept. 11.

“The bounce back nearly erased the previous three-week slide in volume moving the four-week average growth to a -0.1%,” explained Kevin Golden, director of analytics with a la mode.

Check the chart below, which is provided exclusively to HousingWire from a la mode, to see appraisal volume over the past four weeks.

Click to enlarge

(Source: a la mode)

Appraisal volume is an indicator of market strength and holds some advantages over weekly mortgage applications.

For example, fallout is less for appraisals since they are ordered later in the mortgage process, after creditworthiness is determined, and there are few multiple-orders, by the time an appraisal is conducted.