Borrowers who took out mortgages in the past five years are better at paying their mortgages than any other group of mortgage borrowers in history, putting real data to talks that the credit availability pendulum has swung too far the other way since the financial crisis.

Laurie Goodman recently penned a blog for the Urban Institute that brought the severity of the situation into the spotlight, urging that “a near-zero-default environment is clear evidence that we need to open up the credit box and lend to borrowers with less-than-perfect credit.”

To get a proper reading of the mortgage industry, Goodman went back to before the financial crisis to understand what normal would be.

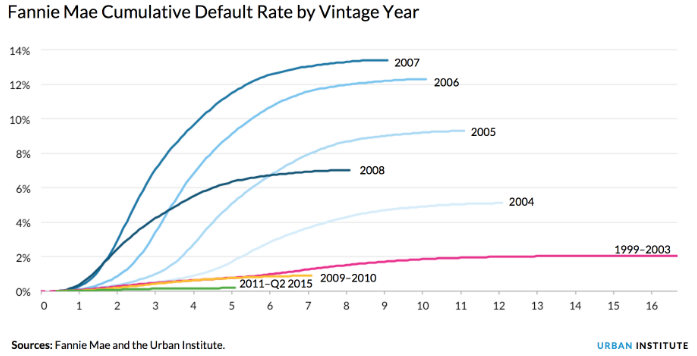

In this case, Goodman compared loans from 2011-Q2 2015 and 2009-2010 to 1999-2003, a period with reasonable lending standards and fairly low default rates.

The following chart shows the data Goodman collected, which illustrates by origination year the rate at which mortgages guaranteed by Fannie Mae have gone six months delinquent.

Click to enlarge

(Source: Fannie Mae and the Urban Institute)

While the 2009–10 vintages are defaulting only marginally less than the 1999–2003 vintages, Goodman explained that the 2011–Q2 2015 vintages with three years of seasoning are hardly defaulting at all.

Some of the improvement is due to a shift in originations toward more pristine borrowers, but it’s not the only explanation. Even when Goodman compared mortgages with the same credit profiles, each group performed better than it has in the past.

So what’s the significant difference? Here’s Goodman’s answer:

As anyone who has taken out a mortgage recently can tell you, the amount of underwriting time and attention to detail is extraordinary, making mortgage origination a very time-intensive business. Originators are spending much more time on each application.

Goodman concludes the piece by calling the industry to action, saying that there is plenty of room to expand the credit box, and “It’s time to lend again to borrowers with less-than-perfect credit.”