Right after the news came out that the United Kingdom voted to leave the European Union, interest rates plummeted and mortgage applications surged, but appraisal volume, not so much.

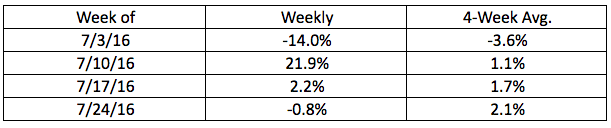

The latest National Appraisal Volume Index from a la mode shows how volume performed over the last four weeks, which includes all of the time that’s passed since Brexit.

In the most recent report for the week of July 24, appraisal volume posted a .08% decline. And only one of the weeks posted any surge at all.

This chart shows appraisal volume, exclusive to HousingWire readers, over the last four weeks.

Click to enlarge

(Source: a la mode)

“It appears that the Brexit ‘surge’ was little more than a trickle. While applications shot up and down, the appraisal starts fluctuations were more modest, indicating that much of the application surge did not run the course to become a mortgage,” said Kevin Golden, director of analytics with a la mode.

Appraisal volume is an indicator of market strength and holds some advantages over weekly mortgage applications.

For example, fallout is less for appraisals since they are ordered later in the mortgage process, after creditworthiness is determined, and there are few multiple-orders, by the time an appraisal is conducted.

After Brexit, mortgage applications surged 14.2%, significantly driven by refinance activity, according to the Mortgage Bankers Association.

While the trend continued the following week, with mortgage applications increasing by 7.2% from the previous week, the impact from Brexit mostly stopped after this report.

Golden explained that although part of the difference could be attributed to refinance applications, some of which do not require an appraisal, the overall effect of refinance activity would be low. He also added that the fallout likely includes more multiple applications that usual.

“Borrowers are not risking not getting a good rate or rejection with a single lender. This is exaggerated when there is a spike or drop in rates and time could be an issue to lock in rates,” he said.