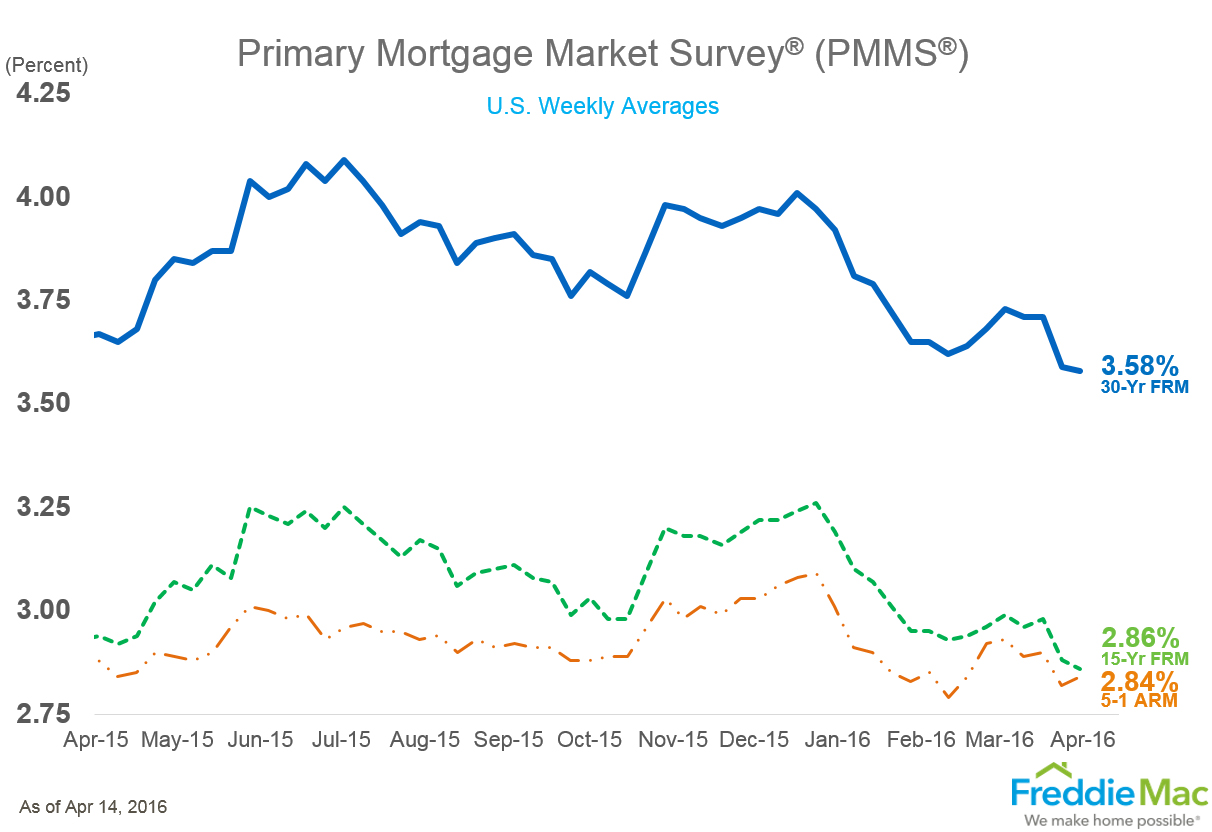

Mortgage interest rates continued their downward trend in the last week, falling again to the lowest level of the year and the lowest level in nearly three years, Freddie Mac’s latest Primary Mortgage Market Survey showed.

This marks the second week in a row that mortgage rates dipped to a new yearly low. Last week, Freddie Mac’s report showed that the 30-year mortgage rate fell 12 basis points to 3.59%, which was the lowest since February 2015.

But rates went even lower in the last week, with the average interest rate for a 30-year fixed-rate mortgage falling by one basis point to 3.58%. One year ago at this time, the 30-year fixed-rate mortgage averaged 3.67%.

This week’s new low of 3.58% is the lowest level that interest rates have reached since May 2013.

"Demand for Treasuries remained high this week, driving yields to their lowest point since February,” Freddie Mac’s chief economist, Sean Becketti said. “In response, the 30-year mortgage rate fell 1 basis point to 3.58 percent. This rate represents yet another low for 2016 and the lowest mark since May 2013."

Also falling was the 15-year FRM, which this week averaged 2.86%, down two basis points from last week, when it average 2.88%. One year ago at this time, the 15-year FRM averaged 2.94%.

Additionally, the 5-year Treasury-indexed hybrid adjustable-rate mortgage averaged 2.84% this week, up slightly from the week before, when the 5-year Treasury-indexed hybrid ARM averaged 2.82%. A year ago, the 5-year ARM averaged 2.88%.

Click the image below for a graphical representation of just how low mortgage rates are right now.

(image courtesy of Freddie Mac)