The common refrain (and an eye-roll-inducing one from those of us that live here) is that everything is bigger in Texas. Well, when it comes to the population of the Lone Star State, the refrain rings true, and keeps getting bigger.

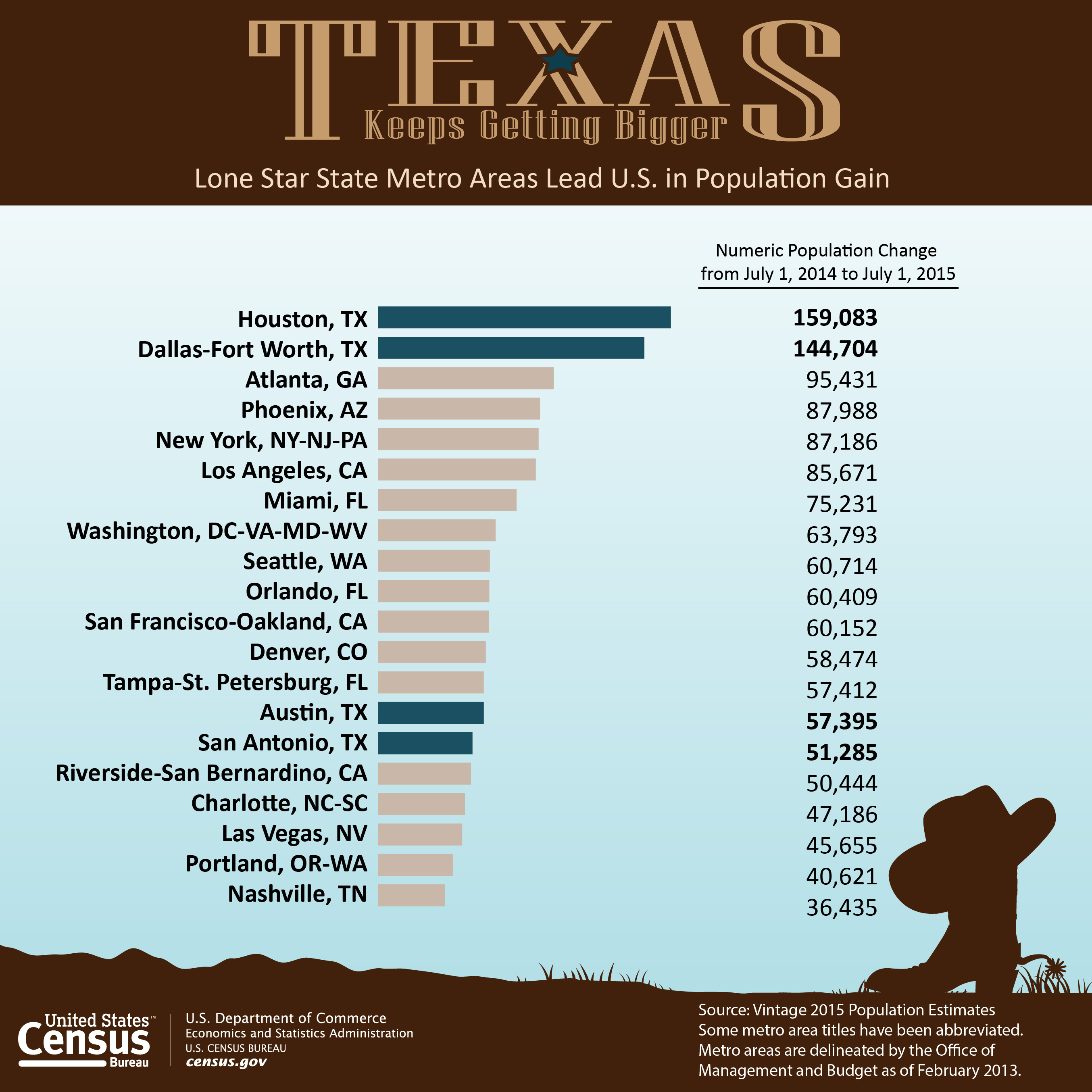

According to data released Thursday by the U.S. Census Bureau, Texas’ two largest metro areas gained more residents from July 1, 2014, to July 1, 2015 than any other metro area in the country.

The latest Census Bureau population estimates show that the Houston-The Woodlands-Sugar Land metro area grew by 159,00 residents from July 1, 2014, to July 1, 2015, while the Dallas-Fort Worth-Arlington metro area grew by 145,000 residents.

In fact, there were four Texas cities in the top 20 for population growth in the referenced time period, with Austin and San Antonio checking in at 14th and 15th, respectively, in population growth.

According to the Census data, these four Texas metro areas collectively added about 412,000 people in the referenced time period, while Texas as a whole gained about 490,000 people.

Those four Texas metro areas collectively added more people last year than any state in the country except for Texas as a whole, according to the Census data.

Other areas that grew substantially in 2015 were Atlanta, which checks in third, having added just over 95,000 people in 2015.

Phoenix and New York round out the top five, both adding more than 87,000 residents in 2015.

Rounding out the top 10 in most residents gained were Los Angeles, Miami, Washington, D.C., Seattle and Orlando.

For the rest of the top 20 metro areas that added the most residents in 2015, click the infographic below.

Click chart to enlarge

(Source: of the Census Bureau)

In terms of metro areas that grew the fastest in 2015, in terms of percentage of population added, The Villages, Florida, a metro area west of the Orlando metro area, was the nation’s fastest-growing metro area for the third year in a row, as its population increased 4.3% between 2014 and 2015.

And five Texas metro areas – Midland, Odessa, Austin, College Station-Bryan and Houston – were also among the 20 fastest growing between 2014 and 2015.

According to the Census data, Houston, Austin and Orlando were the only three metro areas nationwide to be among both the 20 with the largest numeric gains and the 20 fastest growing (percentage gain) between 2014 and 2015.

Other items of note from the Census report include:

- Los Angeles, California, is still the nation’s most populous county with 10.2 million people on July 1, 2015

- The nation’s second-most populous county — Cook, Illinois — experienced its first population decline since 2007: 10,488 between 2014 and 2015 to 5.2 million

- The nation’s metro areas contained 275.3 million people in 2015, an increase of about 2.5 million from 2014

- Most (285 of the 381) metro areas nationwide gained population between 2014 and 2015