Freddie Mac launched its Home Possible Advantage program featuring its 3% down payment option back in December in an attempt to open the credit box for borrowers wanting to jump into the housing market.

But what was designed to help more first-time homebuyers and other qualified borrowers jump into the market has struggled to get off the ground due to lender fears and even borrower misconceptions.

HousingWire addressed the first issue in its recent webinar with Freddie Mac and U.S. Bank titled, “The secret to closing more 3% down mortgages.” A link to the full webinar will be available shortly.

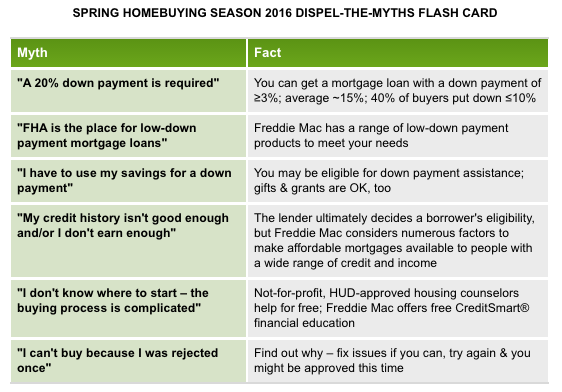

As far as homebuyer misconceptions, Danny Gardner, Freddie Mac vice president, said in a post, “What will it take to green up this year's spring home-buying season with first-time buyers? Information is part of the answer. As an industry, we have to drive a stake through a few stubborn myths that are draining life out of the market.”

One of the most common ones that Gardner mentions is that buyers believe they need a 20% down payment to qualify for a mortgage.

To counter those misconceptions Freddie Mac designed this handy flash card to dispel some of the common myths.

Click chart to enlarge

(Source: Freddie Mac)

For more extensive help, check out Freddie Mac’s Real Estate Professionals Resource Center.