While it doesn’t take long to find a local Walmart or Target, there is a difference between the two when it comes to which one you should purchase a home near.

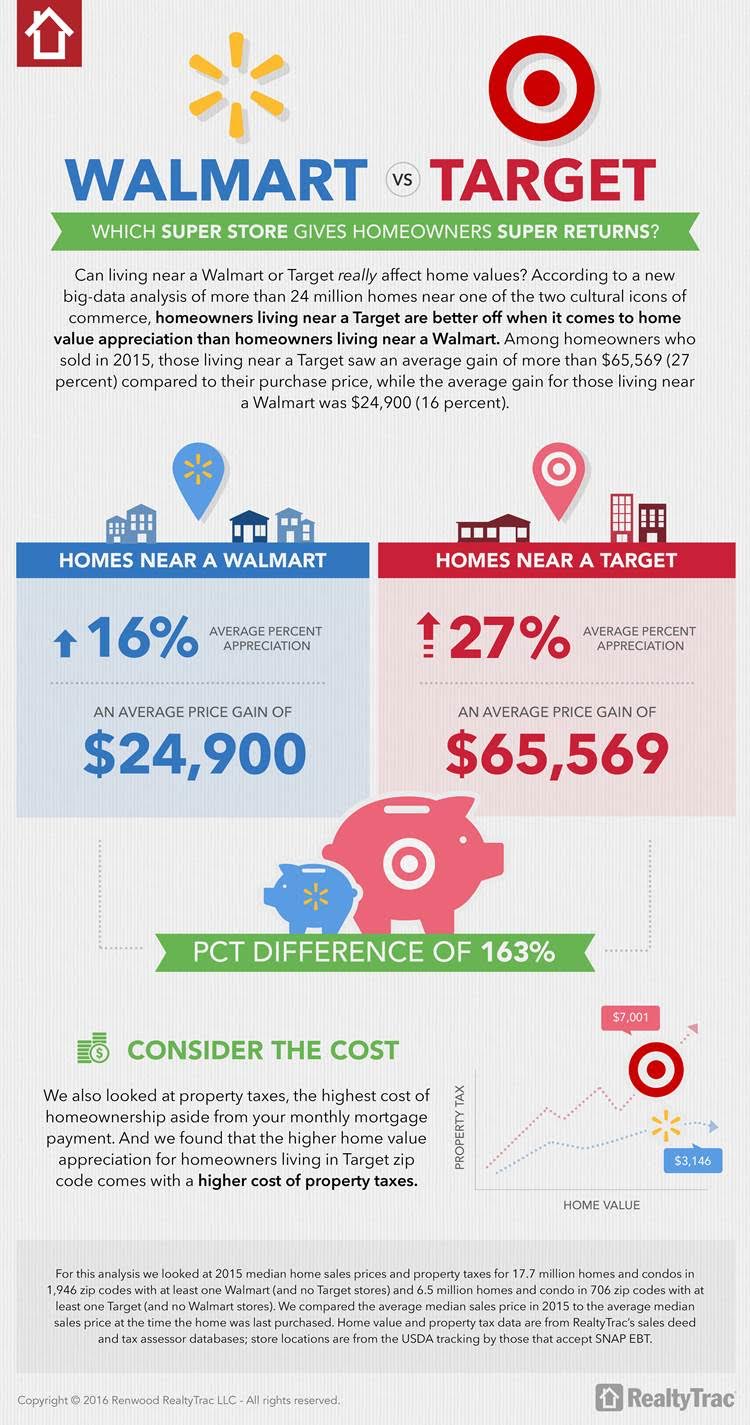

A new analysis from RealtyTrac compared home values, price appreciation and property taxes in U.S. ZIP codes with a Walmart or a Target to determine which superstore gives homeowners super returns.

The analysis looked at home values and property taxes for 17.7 million homes and condos in 1,946 ZIP codes with at least one Walmart (and no Target stores) and 6.5 million homes and condos in 706 ZIP codes with at least one Target (and no Walmart stores).

The winner: Target.

However, it also came at a higher cost.

RealtyTrac found that homeowners near a Target have experienced better home-value appreciation since their purchase, but also pay more and have higher property taxes on average.

Homeowners near a Target paid an average of $7,001 in property taxes, which is a whopping 123% more than the $3,146 average for homeowners near a Walmart.

Plus, homes near a Target also have a 72% higher value ($307,286) than most homes near a Walmart ($178,249).

To help put this in perspective, the report added that the average value of homes was $215,921 across all ZIP codes nationwide, and the average property tax across all ZIP codes nationwide was $4,283.

This chart provides more explanation.

Click chart to enlarge

(Source: RealtyTrac)