HOPE NOW released its final 2015 loan modification data report, claiming 1.45 million homeowners received a foreclosure alternative solution.

HOPE NOW is an alliance of mortgage servicers, investors, mortgage insurers and nonprofit counselors. HOPE NOW did not release data on long-term re-delinquency rates. In other words, there is no way to currently determine how effective these solutions are in the long term.

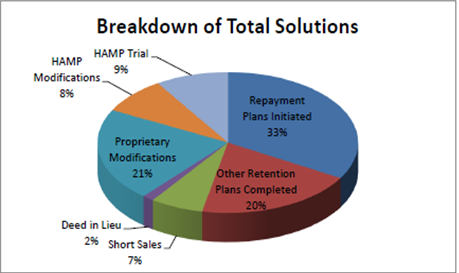

Further, in total, these mortgage solutions include loan modifications, short sales, deeds in lieu and other workout plans.

Reported by the U.S. Department of Treasury, out of the 420,000 permanent loan modifications, 302,000 were proprietary and 117,267 were completed under the Home Affordable Modification Program.

“The 2015 data report affirms the recent trends in housing market recovery," said HOPE NOW executive director Eric Selk.

"Delinquency and foreclosure data continues to decrease and approach pre-crisis norms. Although permanent loan modifications were at a peak of 160,000 in June 2010, they remain around 30,000 a month and nearly 420,000 homeowners received a modification in 2015,” he added.

“Just six years ago, we were at the apex of the foreclosure crisis with over 4.1 million homeowners in serious delinquency and today, we are at 1.6 million,” added Selk.

Here are some more stats:

- Since 2007, the mortgage industry completed more than 24 million non-foreclosure solutions for homeowners, which includes a combination of short- and long-term resolutions.

- Out of the 24.7 million solutions, mortgage servicers completed over 7.75 million permanent loan modifications in that same period.

- Approximately 6.2 million of these loan modifications were completed through proprietary programs and 1,565,723 were through HAMP.

Click to enlarge.

(Source: HOPE NOW)

Foreclosure starts and sales declined significantly in 2015. According to HOPE NOW, there were approximately 705,000 foreclosure starts in 2015, compared to 842,000 in 2014 – a decline of 16%.

Completed foreclosure sales were approximately 342,000 in 2015, compared to 455,000 in 2014 – a decline of 25%.